Implementing observability in cloud-native applications

Implementing observability in cloud-native applications Cloud-native hosting technologies have taken centre stage ever since they were…

Implementing observability in cloud-native applications Cloud-native hosting technologies have taken centre stage ever since they were…

Software mapping is an important concept in the field of software engineering and cloud computing. It…

What is Matrix? Matrix is an open protocol for decentralized, secure communications built on the principles…

The Internet has a plethora of moving parts: routers, switches, hubs, terrestrial and submarine cables, and…

So Fedora Workstation 40 Beta has just come out so I thought I share a bit…

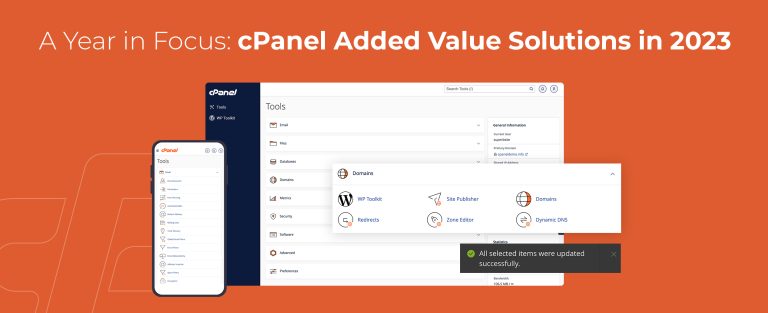

We are happy to announce that coming in Q3 of 2024, with the release of cPanel…

With the year slowly coming to an end, we draw the curtains on yet another chapter…

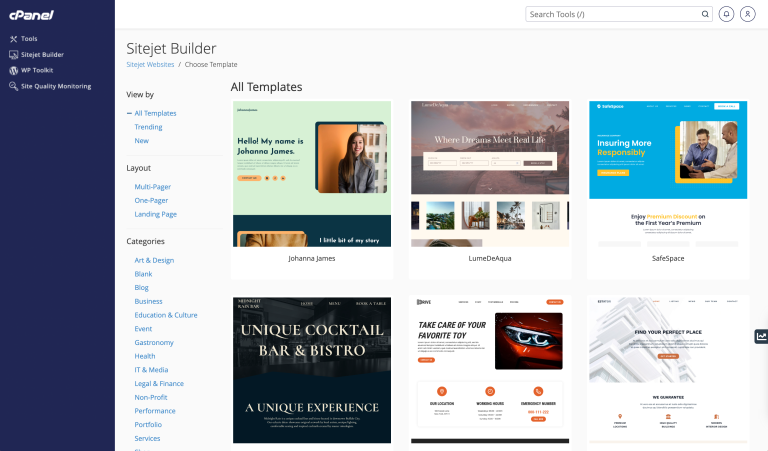

We are excited to start the year off strong by sharing some exciting news: both Sitejet…

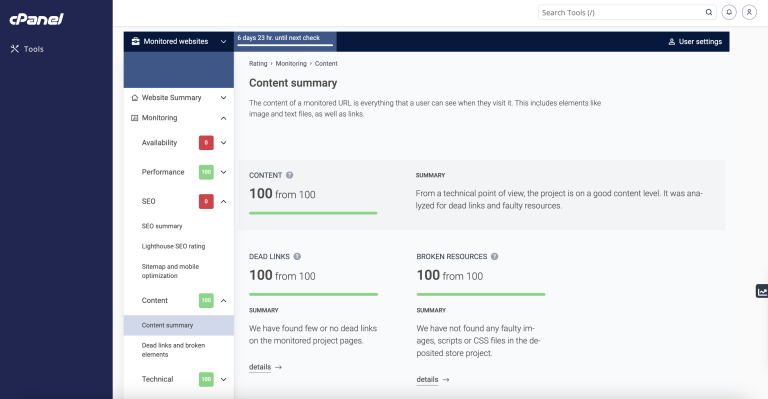

Site Quality Monitoring (SQM) for cPanel is now available with cPanel’s v118, v116, and v110 LTS…

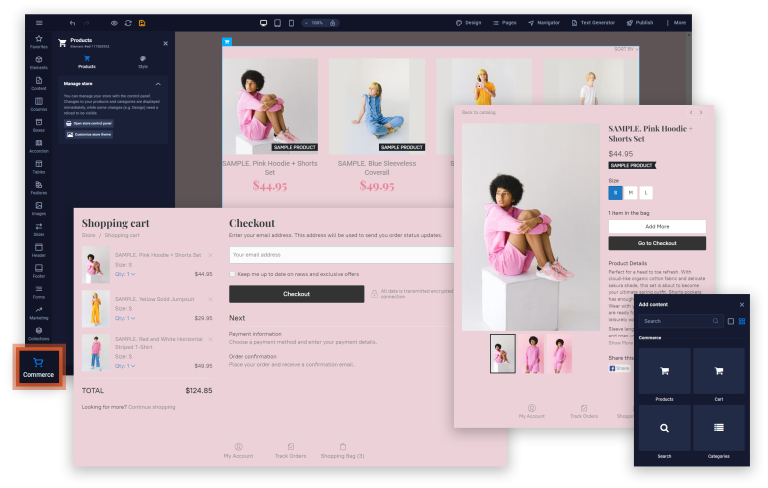

Great news! Are you looking to add an online store to your Sitejet-driven website? With Sitejet…

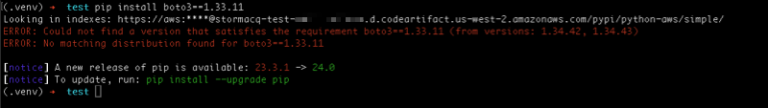

About the Author By James Bourne | 19th March 2024 https://www.cloudcomputing-news.net/ Categories: Applications, AWS, Cloud Computing,…

In an ever-evolving digital landscape, the cloud has emerged as a ubiquitous storage and processing platform…

Starting today, administrators of package repositories can manage the configuration of multiple packages in one single…

Duncan is an award-winning editor with more than 20 years experience in journalism. Having launched his…

We hit a major milestones this week with the long worked on adoption of PipeWire Camera…

About the Author By Duncan MacRae | 14th March 2024 Categories: Applications, Cloud Computing, Companies, Containers,…

Introduction In the realm of Linux distributions, Debian stands out for its stability, security, and rich…