Amazon has become one of the top platforms for eCommerce sellers over the past few years. The company has greatly expanded seller services in an effort to attract sellers from other platforms, and it has new special tools that make it much easier for sellers to track and manage their taxes. We’ll explain everything you need to know about Amazon sales tax and seller taxes in this special report, so stay tuned.

Amazon Taxes: What You Need to Know

Typically, Amazon sellers are liable for the same taxes as other eCommerce vendors. Your main tax responsibility is sales tax, and the platform can automatically calculate and impose sales tax where necessary.

Amazon’s automatic collection makes the sales tax process a lot easier on sellers, but that’s not the end of your tax responsibilities. You also need to pay regular taxes on your income from the platform.

Amazon Sellers Income Tax

When you make money on Amazon, you have to pay taxes on it. US taxpayers are responsible for paying income tax on their earnings, and Amazon income is no exception. Your Amazon earnings will be calculated on your personal tax return, and your tax rate will depend on your tax bracket.

You have to pay taxes on your income, but that doesn’t necessarily mean you will receive a Form 1099 from Amazon. The IRS looks at Amazon as a payment processor, so it doesn’t have to issue 1099 forms for every dollar earned on its platform. Instead, Amazon only issues a 1099-K Form for sellers with more than $20,000 in sales and 200+ transactions on the platform.

Many smaller sellers won’t meet the 1099-K form threshold, but that doesn’t mean you’re off the hook for income taxes. You still need to accurately declare and pay taxes on your income, or you could face penalties and fines from the IRS. Don’t make the mistake of assuming you don’t need to file if you haven’t received a 1099-K form.

Does Amazon Collect Sales Tax?

Yes, Amazon will charge sales tax for every transaction. The marketplace adds the necessary sales tax to every transaction for you, and the buyer pays it at checkout. From there, Amazon collects the sales tax and remits it to the appropriate tax authorities. The process is very streamlined and requires minimal input from individual sellers. You don’t need to worry about filing sales tax returns because Amazon handles it for you.

You don’t have to collect sales taxes from your transactions because Amazon takes care of it for you. Amazon organizes all your sales tax information into a convenient report you can find in your seller central account. The Amazon sales tax report clearly lists your overall obligation as well as state-by-state tax information.

Amazon FBA Sales Tax

Amazon collects sales tax for Fulfillment by Amazon sellers too, but using Amazon’s fulfillment service can create additional tax challenges. Amazon FBA sellers could have a new sales tax nexus in another state. The Amazon fulfillment center that’s handling your goods may not be located in your own state, and it could be determined to be a sales tax nexus by local state tax authorities. Your Amazon FBA sales tax could be higher if your nexus requires you to file sales tax in another state.

As a result, Amazon FBA sellers may be on the hook for additional state sales taxes. Make sure you’re aware of your sales tax nexus count to avoid potential tax compliance.

Marketplace Facilitator Laws

Amazon taxes are much easier on business operators than they were just a few years ago. New legislation called Marketplace Facilitator Laws has cleared the way for Amazon to collect sales tax, making the sales tax process much less resource-intensive for online sellers.

The Supreme Court’s ruling in Quill Corp. v. North Dakota cleared the way for Amazon to collect sales tax on behalf of sellers and remit them to the appropriate state authorities. This ruling means that sellers in every state can now sell items on Amazon without paying state sales tax.

Do Amazon Sellers Pay Sales Taxes?

Professional sellers have to pay taxes on their income streams, so most full-time Amazon store operators will be subject to taxes. However, Amazon sellers with lower sales volume might be able to avoid a tax obligation.

IRS regulations look at these lower-volume sellers as a yard sale-type arrangement. The sales aren’t consistent, and most sellers are reselling personal items for a loss. Therefore, there’s no profit for the IRS to tax. However, if your small online business grows into a steady income stream, you’ll have to report your annual gross sales information to the IRS.

Sales Tax Reporting

Amazon can collect tax obligations for you and file sales tax on your behalf. However, sales tax rates vary by state, so tax obligations could vary significantly depending on the individual Amazon seller. Amazon might be charging sales tax for you, but it’s still up to you to accurately track where your business has a nexus. In order to ensure proper tax compliance, you must properly report your tax information so Amazon tax collection can work properly.

Each transaction includes the proper sales tax rate for the requisite state, and the buyer pays for the tax calculated by Amazon. You don’t have to do anything because your taxes are handled whenever you’re selling products.

Self-Employment Taxes for Amazon Sellers

If you’re a professional seller on Amazon, you probably need to pay self-employment taxes on your gross sales from Amazon. Anyone who earns more than $1,000 on the platform is responsible for paying self-employment taxes, regardless of whether or not you receive a 1099-K form.

Self-employment taxes typically cost 15.3% of your total income, and the same goes for Amazon. These taxes cover the cost of Social Security and Medicare taxes, which would be taken out of your paycheck if you were a W2 employee. However, since you get paid directly from Amazon with no payroll taxes deducted from your checks, you have to pay self-employment taxes to cover the employee and employer portion of these taxes.

Online businesses with earnings of greater than $1,000 should declare their Amazon earnings on their personal tax returns if the business operates through a sole proprietorship or pass-through entity.

Do Amazon Sellers Need a Sales Tax Permit?

You will probably need a sales tax permit to sell on Amazon, at least in your home state. Fortunately, getting a sales tax permit isn’t a very complicated process.

Do I Need a State Sales Tax Permit for Amazon?

To get started, find your state on the State Boards of Equalization. Then, complete the process for your state. Once you have a sales tax permit in your home state, you should be good to go. However, you might need additional sales tax permits if your business has a nexus in another state. Make sure you’re always aware of where your business has a physical presence, or you could get hit with an unexpected tax bill.

Business Permit

Your business probably doesn’t need a permit or business license unless it operates a brick-and-mortar store in a state. Most Amazon businesses don’t need to worry about getting a sales tax permit.

Why Is Amazon Tax Higher Than Normal?

Amazon doesn’t only charge sales taxes. It also charges a 2.9% processing fee for collecting and submitting your sales tax return. The marketplace is allowed to add the extra fee in exchange for their sales tax collection services.

However, Amazon collecting sales tax saves you a lot of time and energy, so it’s probably a worthwhile trade. The downside is that sales tax collection is slightly more pricey on Amazon than you would typically pay.

Sales Tax Exemptions for Amazon Sellers

Amazon’s Tax Exemption Program (ATEP) is available for certain types of qualifying businesses, and the option creates some additional considerations for your online selling business.

States offer sales tax exemptions for a wide variety of reasons, but some examples of common sales tax-exempt organizations include charities, religious organizations, and schools.

If your organization falls into one of these categories, you could qualify for a sales tax exemption in your state.

For sellers, you could run into complications if your buyers fall into the tax-exempt category.

Fortunately, Amazon makes it easy to account for sales to tax-exempt organizations with features that automatically account for such rare exceptions to typical sales tax collection.

The Amazon Tax Exemption Program (ATEP)

Amazon’s Tax Exemption Program makes the sales tax exemption process extremely simple for both buyers and sellers.

ATEP allows sellers to give Amazon permission to automatically handle sales tax exemptions for buyers through their seller account.

You can elect to participate in Amazon’s Tax Exemption Program through your Amazon Tax Settings dashboard.

Once enrolled, Amazon will automatically account for your buyers with active sales tax exemption status. If your buyer is sales tax exempt, Amazon will automatically remove any applicable sales taxes from the transaction, and you don’t have to do anything on your end.

However, this procedure won’t apply if the buyer in question isn’t actively registered and enrolled as tax-exempt within Amazon.

Buyers who don’t participate in ATEP or who otherwise cannot apply their exemptions at the initial time of purchase could request a sales tax refund down the road. Using ATEP doesn’t guarantee you can avoid this potential snag for sellers.

Fortunately, Amazon allows sellers to issue a refund on an order’s collected taxes at any time so, if you run into this problem, it’s relatively easy to rectify. However, if you use Fulfillment By Amazon services, you will have to direct your buyer to Amazon customer service.

The ATEP system offers obvious convenience benefits over handling the process manually, but ATEP also offers some noteworthy compliance benefits.

Proof of Exemption

Sales tax exemptions aren’t handed out lightly. Many states are very strict about issuing tax exemptions, and they want documentation to verify each buyer’s status.

Amazon’s ATEP system makes compliance much more certain. The platform’s automatic handling also includes the collection of buyer exemption documentation on a per-order basis, ensuring that each transaction is verified as sales tax exempt.

Amazon also stores tax exemption documents internally, and sellers can access them at any time through their account’s Tax Document Library so you can quickly produce proof of each buyer’s status if needed.

However, there are a few nuances you should know about. Amazon validates that a buyer has provided the necessary information for their enrolled exemption status, but it’s ultimately up to the buyer to provide and maintain their exemption information and use it properly.

Amazon doesn’t validate the information provided by the buyer with any official tax authorities.

A buyer who defrauds this process could sneak by in theory, but sellers shouldn’t have to worry about this as long as they follow proper procedures and reasonable due diligence.

How Does the Amazon Tax Exemption Program Work?

ATEP makes transactions between enrolled buyers and sellers painless and straightforward. If a sales tax exemption is applicable, Amazon automatically calculates it into the transaction. Here’s how it works:

When an ATEP-enrolled buyer makes a purchase, Amazon automatically determines whether the buyer has an active exemption for their order destination. If the transaction qualifies, Amazon automatically applies the exemption to all items in their order.

If the buyer’s exemption doesn’t apply to the order destination, Amazon will not issue an exemption for that particular order. Exemptions are specific to the selected tax jurisdictions on a buyer’s account.

Before checkout, tax-exempt buyers will have the option to remove the exemption from individual items in the order so they can pay necessary taxes on any items that don’t qualify for a sales tax exemption.

Amazon allows buyers to handle the process manually because exemption rules vary by state and taxing jurisdiction. The feature allows buyers to choose between taking the exemption or paying taxes on each item depending on whether it fits the exemption criteria for their tax jurisdiction.

For sellers, there isn’t much to do. The responsibility primarily rests between Amazon and the sales tax-exempt buyer. All you have to do is sell and keep on selling.

How to Enroll in ATEP

Participation in the Amazon Tax Exemption Program is optional for all sellers. However, opting into the program could make your life as a seller much easier.

ATEP could potentially reduce instances of buyers requesting post-order refunds for sales taxes on an order. You may also find that you’re receiving fewer questions about your store’s tax settings.

Ultimately, ATEP could make sales tax collection more streamlined and convenient for both buyers and sellers. If you want to participate in ATEP, you can opt into the program through your Amazon account’s Tax Settings page.

Tax Exemption Codes for Amazon

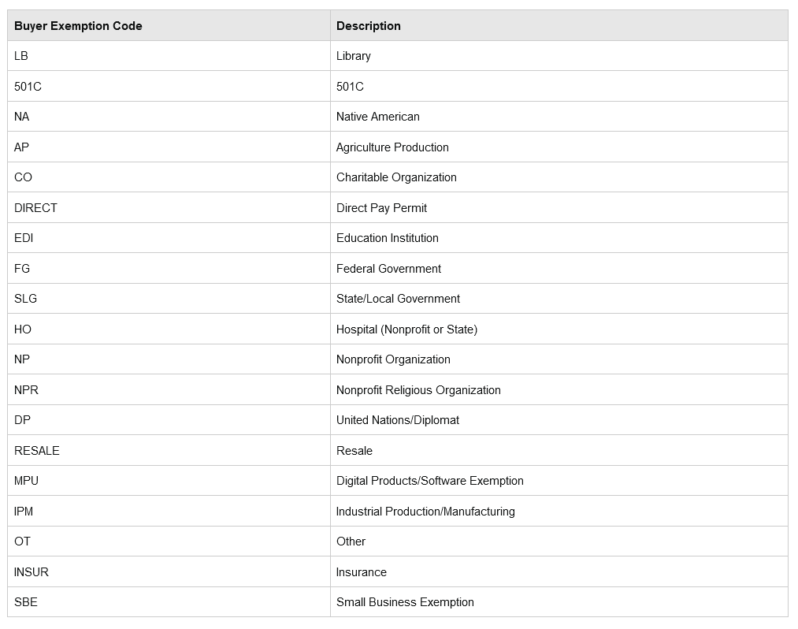

If you’ve sold to tax-exempt buyers in the past, you might be wondering about those codes listed on your Amazon Sales Tax Report.

Each code represents a different classification of businesses that qualify for sales tax exemptions on their orders. Knowing what these codes mean could lead you to additional insights into your sales numbers and customer demographics.

You can use this table showing every Amazon Buyer Exemption code and its corresponding designation to decipher the labels you see on your Amazon Sales Tax Report:

As you can see, there are many types of organizations that can qualify for tax-exempt status on Amazon. Many organizations in these categories could have large spending budgets that could make them excellent customers for your business, so it’s worth keeping an eye out for these codes.

Common Tax Deductions for Amazon Sellers

Small business owners can reduce their overall tax obligation by tracking and declaring their business expenses. You can deduct these costs from your adjusted gross income to reduce your taxable Amazon seller income.

An Amazon seller or Amazon FBA seller can usually write off expenses like these:

- Advertising

- Home office expenses

- Merchandise

- Contractors

- Office supplies

- Transaction fees

- Shipping costs

- Software

- Internet

- and more…

You can report these deductions when you file taxes at the end of the year. Your goods sold will remain the same, but the deductions can greatly reduce your taxable profit.

Taxes are Part of Every Business – Even Ecommerce

Whether you’re trying to stay on top of Amazon sales tax, or considering its implications for your business, one thing is certain – you can’t escape them. If tax season makes your head spin, you’re not alone. The team of professionals at TaxHack is offering Ecommerce CEO readers a complimentary strategy session to ensure you’re compliant with all local, state, and federal tax laws while growing your business.