The 2021 holiday season is already in full swing, and Thanksgiving hasn’t even arrived.

There are industry predictions of solid, double-digit e-commerce growth and record sales, despite lapping the COVID-induced spike in e-commerce last year. Adobe Analytics has forecast 11% year-over-year growth globally for holiday e-commerce sales, with a 5% year-over-year increase during the traditional Cyber Five shopping days from Thanksgiving through Cyber Monday.

E-commerce is accustomed to seeing significant holiday gains each year. But after the historic growth in 2020 due to the pandemic — and the supply chain issues that continue to wreak havoc on warehouses and fulfillment providers — some have speculated that holiday e-commerce growth in 2021 might be more muted.

Also, when considering global numbers, there are countless country-specific, pandemic-related situations to consider, especially in Europe. New lockdowns in Austria and the Netherlands could push more shopping online, and other European countries are introducing more stringent Covid mitigation measures as well.

In short: the 2021 holiday season will be complicated to contextualize. But from what we can tell, it’s off to a really strong start.

Many predicted that global supply chain issues would cause holiday shoppers to shop earlier this year and “pull” some GMV from November and December forward into October. Though category growth leading up to Thanksgiving seems strong, we won’t be able to get a complete picture of how holiday GMV was distributed across the quarter until after the holidays have ended and the dust has settled.

So which categories are seeing growth leading into this holiday season?

Same Store Sales Category Performance

Please Note: The gross merchandise value data presented below (“GMV”) is based on aggregate sales activity through our platform on marketplaces across our entire customer base globally. The growth percentages are based on daily average Q4 “same store sales” (i.e., only accounts generating sales in both time periods were factored into the calculations). This material includes highlights concerning certain product categories. Because marketplaces have different category structures, the data is presented using categories that have been standardized by ChannelAdvisor. These metrics may not represent overall e-commerce activity or the performance of any individual business, including ChannelAdvisor or any individual marketplace. Unless otherwise noted, all calculations are done in USD and are not normalized to account for fluctuating exchange rates.

The week of Thanksgiving in the United States marks a symbolic start of the holiday shopping season, even globally, where “Black Friday” sales are increasingly common. While it’s too early to tell whether global supply chain issues have pulled forward GMV in Q4 2021, it’s instructive to have a look at Q4 category growth entering the week of Thanksgiving.

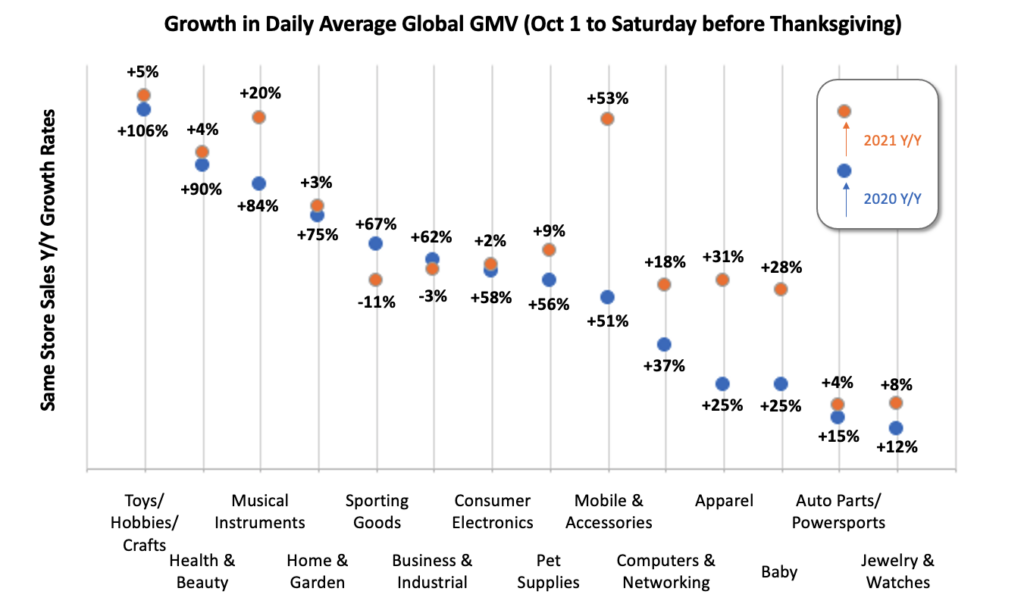

The chart below highlights the year-over-year growth rates by category for average daily global Q4 GMV leading up to the week of Thanksgiving. Because we are using the “same store sales” methodology, these numbers are independent of any changes in ChannelAdvisor’s customer base. With pandemic restrictions loosening in 2021 and extremely strong growth in 2020, any growth in 2021 on top of the impressive 2020 growth (which included Prime Day in October) suggests that the acceleration in e-commerce adoption from 2020 has, thus far, stuck.

Most of the categories with the strongest year-over-year Q4 growth in 2021 were those that were below the median of category performance in 2020: mobile phones and accessories (+53% in 2021); apparel (+31%); baby (+28%); and computers/networking (+18%). The musical instruments category (+20%) is also having a strong Q4 2021 after impressive growth in 2020. The sporting goods and business/industrial categories are the only two that didn’t grow in Q4 2021 leading up to Thanksgiving week.

After months of preparations, the holiday shopping season is officially here. But for many brands and retailers, the holiday shopping season has already been in full swing for weeks. Stay tuned to the blog for more updates throughout the holiday season.

![[Guest Blog] How to Reduce E-Commerce Returns This Holiday Shopping Season](https://thegateway.net.au/wp-content/uploads/2021/03/guest-blog-how-to-reduce-e-commerce-returns-this-holiday-shopping-season.jpg)