Though blogging has a reputation as being the ideal online job, doing it professionally is managed much like you would manage any other type of business. This means that come April 15th — tax time — you will need to file taxes.

Today will be discussing everything you need to know to file blogger taxes for the first time. I’ll cover things like whether your blogging efforts are considered a hobby or business, the type of taxes you can expect to pay, the forms you’ll need, the tax deductions you can take no matter your niche, and more.

Please note that if you need specific advice you should always consult a professional tax preparer or direct your questions to the IRS. This article is provided for informational purposes only.

Hobby or Business?

Before you do anything else, you need to determine if your new blog would be considered a hobby or a business in the eyes of the IRS. Whether you blog once in a while, are a side-hustle blogger, or make money from blogging, there’s a fairly straightforward set of nine factors you can review to make this determination:

- Are your blogging efforts conducted in a business-like way?

- Do you intend to make a profit?

- Is your blogging income at least part of how you make a living? Are you a full-time blogger?

- If you have losses, do they mirror what’s expected of a start-up business owner?

- Do you change what you’re doing to increase profit?

- Are you knowledgeable enough to run your own business?

- Have you previously made a profit writing a blog post or something similar?

- Has your blog become profitable over the years?

- Do you expect to make a profit in the future?

If you answered yes to these questions, then your blog is a business, and you will need to file taxes.

Types of Taxes for Bloggers You Can Expect to Pay

As a blogger, you’ll be accountable for paying taxes in two ways: income tax and self-employment tax.

Income Tax & Estimated Taxes

When you work as a blogger, you usually do not receive a W-2 from an employer each year, which means no taxes are withheld from your paycheck throughout the year. Because of this, you will need to pay estimated taxes on your projected income.

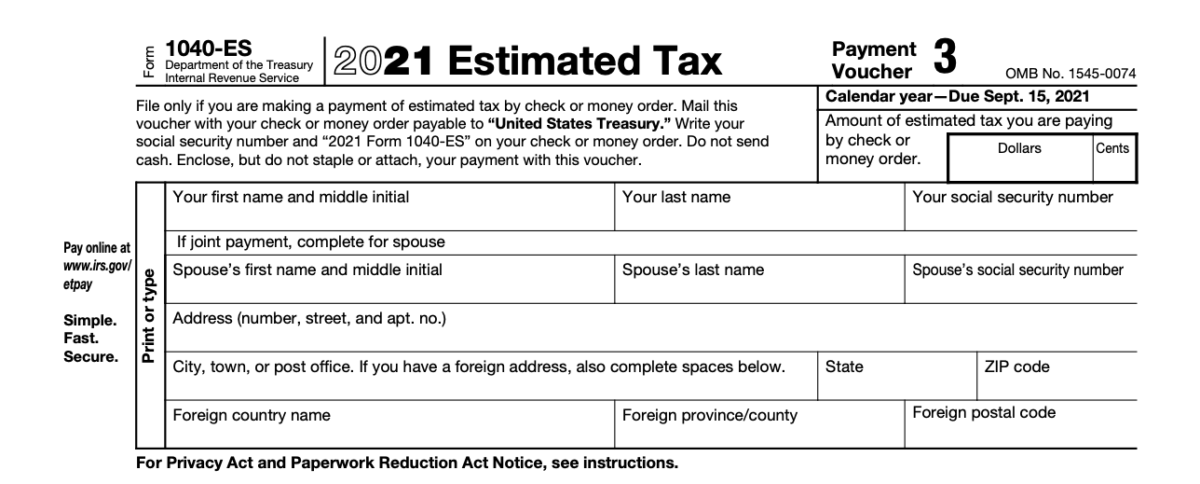

Estimated taxes are typically divided into four installment payments due on April 15, June 15, September 15, and January 15 that you pay before filing your taxes for the year. You will file these quarterly payments along with Form 1040-ES.

Typically, if you don’t expect to owe more than $1,000 in tax liability by the end of a tax year, you may not have to file estimated taxes. However, if you do end up owing more than this, you may be on the line for penalties.

Self-Employment Tax

Now while you’re saving money from your income as a blogger, you’ll also need to set aside money to pay self-employment tax. Self-employment tax is the combination of Social Security and Medicare taxes that would typically be paid by your employer. Since you are self-employed as a blogger, you are responsible for both employee and employer portions of this tax.

What is a 1099-MISC Form (or 1099-NEC)?

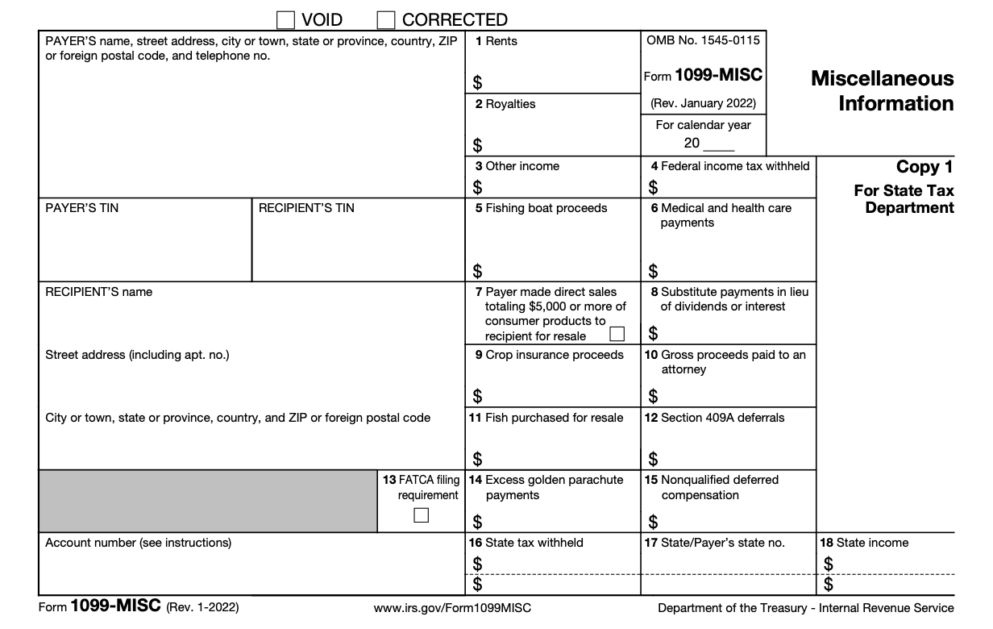

A 1099-MISC form is typically how bloggers receive information from their clients regarding the amount of money they’ve earned that year. At least, that’s how it used to be until the introduction of the 1099-NEC. Many bloggers who write for other blogs besides their own will receive a 1099-MISC (now 1099-NEC) Form at the end of a tax year that includes the total amount earned.

If you make your money through affiliate links through affiliate programs on your blog, you will still likely receive at least one 1099-MISC Form at the end of the tax year (usually sometime in January).

In some cases, the relatively new 1099-K will be required rather than the 1099-MISC. If specific requirements are met, you will be sent a 1099-K. This is the form institutions like PayPal and Venmo are now sending.

You will use these forms in place of a traditional W-2 to report to the IRS how much money you made.

How to File Blogger Taxes as a Part-Time Blogger, Gig Worker, or Sole Proprietor

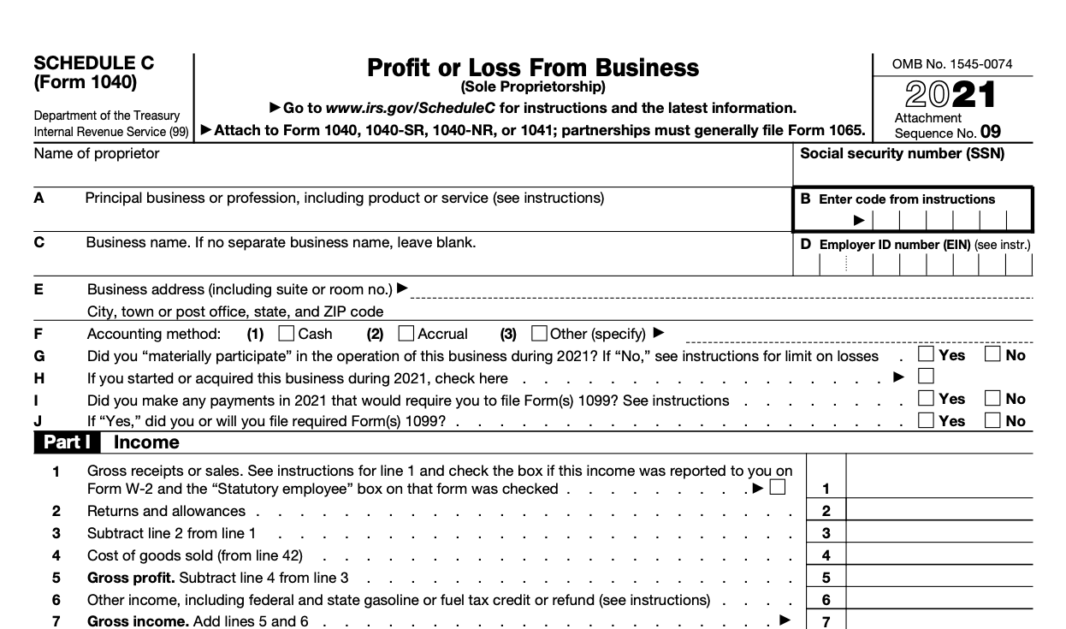

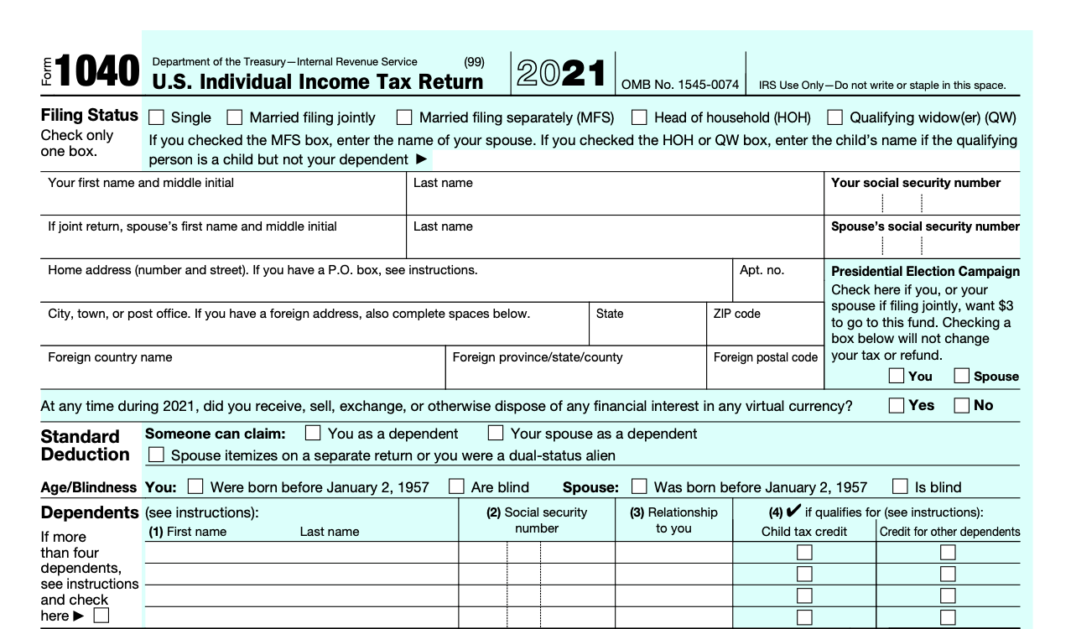

Most people who need to file an income tax return will do so as sole-proprietors. You need two primary forms when filing during tax season: a Schedule C and a 1040.

Schedule C

The Schedule C is a part of Form-1040 and is where you log the profit or loss from your business as a sole-proprietorship and report your business income.

Form-1040

Yes, you will still need to file your personal income taxes as a part of your annual tax return.

To do so, you simply need a standard Form-1040. You will file this along with your Schedule C by April 15th each year, along with your quarterly estimated taxes as previously described.

You will need to file state taxes as well – and ensure you’re up-to-date on any required state licenses. Be sure to review your state’s requirements before the filing deadline.

How to File a Tax Return for a Limited Liability Company (LLC)

Some bloggers opt to form an LLC because of the protection it provides to your personal property. Basically, under this organization, your home won’t be considered collateral for your business loans.

[Sole-Proprietorship vs LLC graphic here]

As for which forms you will need to file, as a single-member LLC, it will be nearly identical to the process sole-proprietorships use. You’ll need to file a 1040 with a Schedule C. You also need to file self-employment taxes and estimated taxes on your taxable income.

If you have a partnership-based LLC, you’ll need to file a Form-1065. You will also need to report your share of the business’s income on a Schedule K-1.

Common Tax Deductions and Business Expenses for Bloggers

[Common Expenses graphic here]

As you prepare your blog income taxes each year, it’s essential to keep track of your blog expenses. You should make every effort to deduct all relevant business expenses for running your business. A few common categories for tax deductions include:

- Computer: Any hardware you purchase throughout the year can be deducted.

- Tax and accounting fees: Tax software, accounting software, and tax preparer’s fees count.

- Membership dues: Fees for memberships (like the Freelancer’s Union) qualify here.

- Online subscriptions and services: Fees paid for subscriptions to online tools and services you need to access to complete your job. For instance, subscriptions to plugins, themes, SEO and analytics tools, social media tools, fees paid for blog design work or blog framework, and so forth.

- Assignment-related costs: If you need to spend money to complete a work task, you can deduct it.

- Web hosting: The hosting fee for your blog counts here.

- Mobile phone: If you have a dedicated mobile number for business calls, you can deduct that service. Or, you can deduct the relevant percentage of the fee for the time you use it.

- Internet & utilities: The same goes for your expenses incurred for internet and utility fees. You can deduct the relevant percentage on your taxes.

- Home office: If you work from home, you can deduct the space and office furniture used to complete your work. You will need to bust out the measuring tape, but it’s worth the effort!

- Office supplies: As a blogger, the IRS might expect you to deduct things like paper, postage, printer ink, pens and pencils, and other related office supplies.

- Travel & gas: If your blogging business requires travel, you can deduct a portion of the business expense incurred on mileage.

- Marketing: Fees incurred on web ads, guest blog placement, social media promotions, and social boosting qualify here.

Blog Tax Tips

Before we part ways, I’ll leave you with a few tax tips for any self-employed blogger to follow to ensure filing your taxes goes as smoothly as possible.

- Pay your estimated quarterly taxes. Not only could a failure to do so result in a litany of penalties and fines, but it also means you’ll be stuck scrambling to pay the tax bill once it comes due. Save money throughout the year to meet this tax obligation. Save yourself the headache.

- Keep thorough records of all expenses. For some, this means keeping every receipt for every transaction you make related to your business. Other people like to use automated services to keep track of their expenses that sync with their bank accounts. I’d prefer this method as it’s more hands-off, and it’s less likely to result in errors. You can use a tool like QuickBooks Self-Employed to log and track your tax write-offs automatically and then import them into your tax forms when the time comes.

- Weigh your tax prep options. As soon as you even have an inkling that you might make a profit as a blogger, it’s important to weigh your tax preparation options. Using a tax filing service like TurboTax can be very helpful. But if you anticipate having more complex taxes, then such a service may leave you open to errors. An accountant or tax professional might be necessary in these cases.

FAQs

Prepare Your Taxes With Confidence

How did your first time filing taxes as a blogger go? I’d love to hear all about it below.

![Winning TikTok Video Ideas and Best Practices [+ Examples]](https://thegateway.net.au/wp-content/uploads/2022/03/winning-tiktok-video-ideas-and-best-practices-examples-768x249.png)