Krish Iyer, Head of Industry Relations and Strategic Partnerships at ShipStation, recently spoke at ChannelAdvisor Connect about the changes taking place in international marketplace selling.

His talk “International Marketplace Selling 2021 and Beyond: What Happened in 2021 That Affects You This Year and Beyond?” can be viewed on-demand here, however, for ease of disseminating his important observations, we have put together an overview of his key points.

Ultimately, foresight is invaluable in the e-commerce space. Krish not only articulates the role COVID-19 has played in the e-commerce boom, but simplifies many of the complex changes being made to international shipping procedures.

Krish shares a message of optimism when he states, “if you’re willing…to be patient and learn the process, then you have billions of customers you can market to.”

The International Trade Explosion Explained

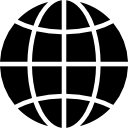

E-commerce has grown rapidly due to the COVID-19 pandemic. E-commerce has been said to have “taken over” in once busy city areas, but it has also flourished in remote and rural areas, particularly across Asia.

This shift has occurred alongside the rise of mobile devices, which have put the world’s online marketplaces at people’s fingertips. The pandemic may have been the catalyst for the large-scale change in consumer habits, but the technology was already there.

For e-commerce retailers, this is extremely good news. However, this boom has also come with a downside, namely, the challenge of engaging with international markets and regional differences.

Issues around shipping duties, new and changing border situations (think Brexit) and things like the EU’s new value-added tax (VAT) throw extra complexity on the opportunity.

Duty vs VAT and the role of De Minimis

In most cases, the biggest hurdle is determining the difference between a duty and Value-Added Taxes (VAT). Thankfully, they have clear differences and can be easily explained.

Duties refer to those tariffs or taxes that get imposed on goods when they cross an international border.

VAT is a tax on goods that is added at the production stage, typically during the final stages. VAT is calculated at a fixed percentage.

However, if you are concerned about international taxes being imposed on low-value items, then you may be pleased to learn about ‘de minimis’.

De minimis ensures that goods and services can only be taxed or subject to duties if they hold a certain value. Anything under the value threshold will pass through tax-free.

In the USA, the importation de minimis is US$800, a healthy threshold even for many luxury goods. In contrast, the threshold in the EU has been scrapped, meaning that all non-EU sellers are liable to pay VAT regardless of the value of their goods.

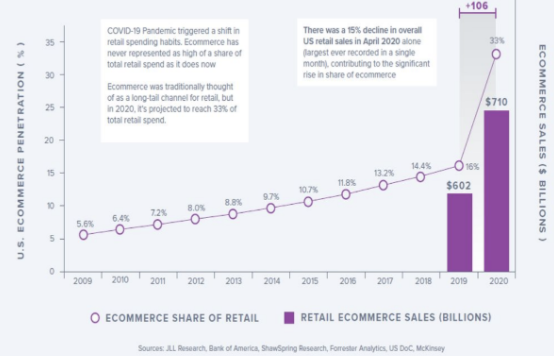

The obvious question to this might be: Why?

And the answer is simple: the EU wants to encourage internal spending, while maximizing their tax revenue.

Thankfully, if you are an international importer into the EU, all hope is not lost. Market potential is still excellent, especially if you adopt logistics processes that reduce costs.

The International Marketplace after USMCA and IOSS

In most cases, the best way to optimize your shipments will be through making arrangements with the appropriate postal authority. This will entail making contact with a postal authority in an EU country yourself and then coming to an agreement that streamlines the import process.

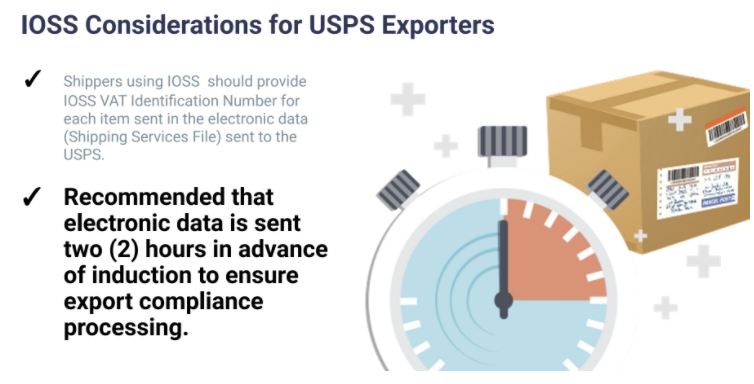

Alternatively, importers can exclusively utilize a system called the IOSS. The IOSS stands for Import One-Stop Shop, and is designed to simplify the declaration and payment of VAT, at a cost benefit to your business.

You can register on the IOSS portal of any EU Member State and it will work for any country that is within the EU. This process takes 7 – 10 days to complete, and your IOSS number should be added to your Shipping Services File to make your import compliant.

Learn how ChannelAdvisor’s partnership with ShipStation can simplify your imports into the EU and beyond. For more information visit shipstation.com.