The year 2020 has certainly seen its share of unique events. One of them happened after Q2 ended, when Google reported a decline in revenues for the first time in its history. And while that announcement may pale in comparison to the other historic events of 2020 when we look back on it ten years from now, the news was still very impactful for those of us in e-commerce who had never seen it before.

Perhaps unsurprisingly, Google bounced back strongly with a more upbeat story as it reported its Q3 results. Revenue increased 14% for the quarter led by strong growth in YouTube and Cloud.

Some highlights from the quarter:

- Revenue increased 14% for the quarter (15% on a constant currency basis) totalling $46.2 billion.

- Advertising revenues were $37.1 billion — an increase of 9.8%.

- Search revenues were $26.3 billion — an increase of 6.5%.

- YouTube ad revenue was $5.0 billion — growing 32.4%.

- Google Cloud revenue was $3.4 billion — growing 44.8%.

- Other revenue, which consists of Google Play, Hardware and YouTube’s non-advertising services, was $5.5 billion — growing 35.3%.

- Operating income was $12.6 billion, up from $10.7 billion a year ago.

- Hiring continued, and Google now has 132,000 employees.

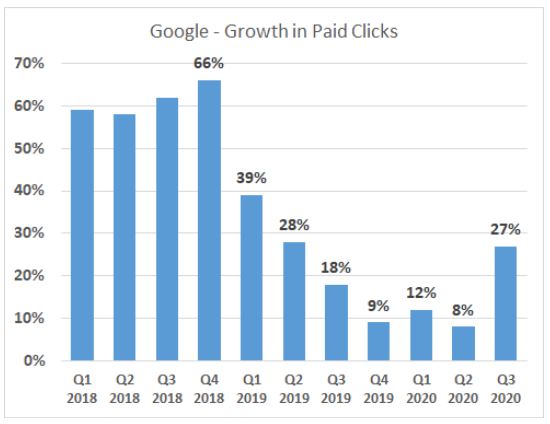

- Paid clicks increased 27%, average cost per click declined by 15%.

One trend we watch very closely is the slowing growth rate of Google’s core search advertising business. For Q3, Google Search revenues were up 6.5% which was significantly better than Q2 however still was behind the growth rates reported by Facebook (22%) and Amazon (51%).

Over the last several months — as the pandemic took hold — Google extended free options for merchants. At first, merchants were given the ability to list products for free in Google Shopping. More recently, Google announced that the Buy on Google program will have zero commission rates as well. These changes are all about improving the “comprehensiveness” of core Google Search. The theory, of course, being that if consumers don’t feel like their search results represent the universe of available products, they will search elsewhere. Based on Q3 results, it doesn’t appear that these changes have negatively impacted the growth in paid clicks. In fact, perhaps the opposite is true. Paid clicks increased by 27%, which was the highest growth rate since Q2 2019.

So, is Google back? We would argue that, for brands and retailers, the search giant never went anywhere. And it will continue to be one of the most important channels for reaching consumers both online and in-store.

It will be interesting to see how the holiday season shakes out as everyone in e-commerce prepares for another record season for online shopping.