Please Note: The gross merchandise value data presented below (“GMV”) is based on aggregate sales activity across our entire customer base globally and includes sales from all channels excluding digital marketing channels. This material also includes highlights concerning certain product categories. Because marketplaces have different category structures, the data is presented using categories that have been standardized by ChannelAdvisor. This GMV may not represent overall e-commerce activity or the performance of any individual business, including ChannelAdvisor or any individual marketplace. Unless otherwise noted, all calculations are done in USD and are not normalized to account for fluctuating exchange rates.

Prime Day 2021 – GMV Robust Despite a Tough Comparison

Based on our data, e-commerce volumes continued to be robust over the two days spanning Amazon Prime Day this week. Considering that last year’s Prime Day was in October — leading up to the holidays and during a period where most of the world was still under heavy lockdown due to COVID-19 — it wasn’t clear if we’d see meaningful GMV growth this year with Prime Day’s move to June, a less seasonally active time of year, and with pandemic restrictions receding. However, virtually all of our leading channels exhibited GMV growth compared to last October’s Prime Day, with some channels up modestly and others up well over 100%.

Overall, compared to last year’s Prime Day, growth on Day 1 was stronger than on Day 2, but Day 2 yielded the highest level of single-day GMV we’ve recorded so far in 2021, exceeding the stimulus bump we saw in mid-March of this year.

We also continued to see very strong performance from our “long tail” of marketplaces, which in aggregate have recently been driving more GMV volume on our platform than eBay and Walmart, highlighting the increasing diversification of GMV across multiple channels and the increasing array of channels that online sellers have to reach consumers.

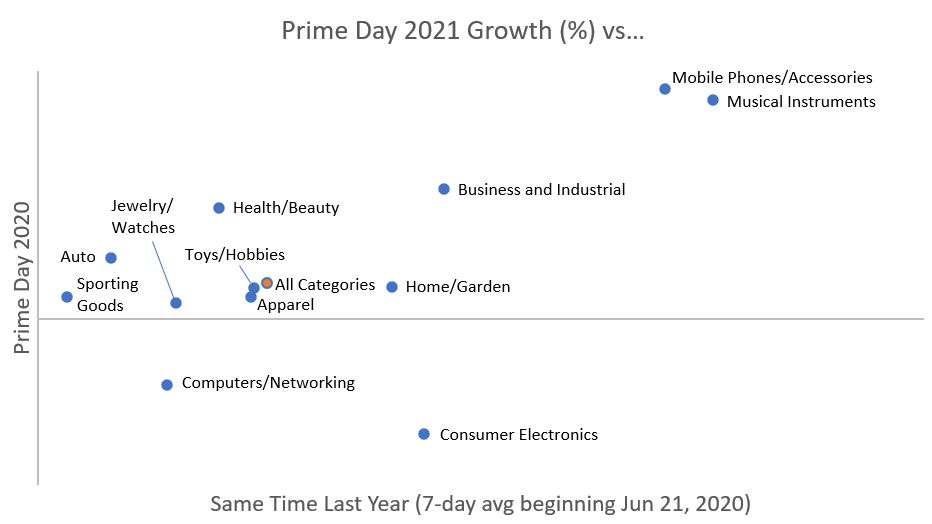

Which Categories Performed Best?

Yesterday, we highlighted the relative performance of various categories following Day 1 of Prime Day. Today, we have updated this data to incorporate both days of Prime Day 2021. While the total results are relatively close to the Day 1 results, there were several notable movements:

- Mobile Phones/Accessories had a strong Day 2 and overtook Musical Instruments as the category with the highest percentage growth from Prime Day 2020 to Prime Day 2021.

- The Home and Garden category had the largest dollar gain from Day 1 to Day 2 during Prime Day 2021. However, due to significant GMV on Day 2 during Prime Day 2020 in this category, the overall growth rate dropped from what we saw following Day 1.

- Similarly, the Jewelry and Watches category had lower growth rates in 2021 on Day 2 despite a modest increase in GMV from Day 1 to Day 2.

- Following Day 1, the Prime Day growth rates of the Computers/Networking and Consumer Electronics categories were roughly the same (both negative from Day 1 of Prime Day 2020 to Prime Day 2021). On Day 2, Computers/Networking performed better and Consumer Electronics performed worse relative to Day 1 growth rates.

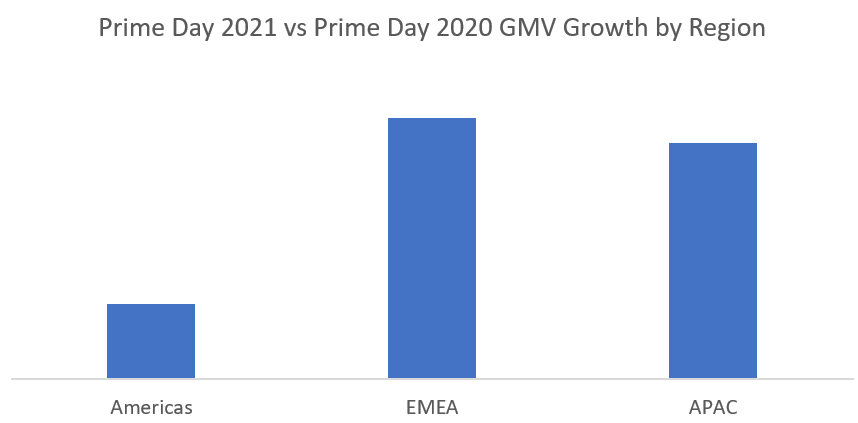

A Global Phenomenon

Amazon Prime Day is a global phenomenon at this point. While all regions grew from Prime Day 2020 to Prime Day 2021, GMV in EMEA and APAC increased by approximately three times the rate as in North America.

Looking Forward

Prime Day 2021 saw GMV growth across all regions and most categories. As we look forward to the rest of the year and Prime Day 2022, it remains difficult to forecast e-commerce volumes. However, with Advanced Child Tax Credit Payments scheduled to begin July 15 in the U.S., we believe this additional stimulus could continue to support robust e-commerce volumes even as pandemic-induced restrictions fade.