There are several inventory valuation methods to determine your company’s asset value. As a business owner, it’s important to know which works best for your company and how they affect your bottom line.

In this blog post, we will discuss some of the most popular ways to calculate an asset value on inventory, highlighting the pros and cons of each method.

Let’s dive in.

What is Inventory Valuation?

Inventory valuation calculates how much your inventory is worth at the end of the fiscal year. There’s no single right way to approach inventory valuation. The most common inventory valuation methods are:

- Weighted average cost method

- Specific identification method

- First in first out (FIFO) method

- Last in first out (LIFO) method

Knowing and tracking this information will help you make better decisions regarding eCommerce management, so that any balance sheet fluctuations don’t hurt profit margins too much.

Why is Inventory Valuation Important for Business?

It’s crucial to understand inventory value accounting. How much your inventory is worth affects the cost of goods sold (COGS). It is a critical measurement of your business’s overall financial health. Inventory valuation provides useful information for making financial decisions.

In business, things can change rapidly. Inventory valuation helps determine the value of your business should you decide to sell.

Challenges in Inventory Valuation

It might be tough to calculate the worth of your inventory if you’re a small or medium-sized business with little to no investment in inventory tracking.

When you work with an accountant, inventory valuation is simpler for small and growing enterprises. Order fulfillment services also make managing inventory easier for businesses.

Large Volumes of Stock

Thousands of units in stock is quite common for a growing ecommerce company. It might be difficult to calculate the present value of inventory without good inventory management.

If you have more inventory in stock than you can sell, you may be paying too much in carrying costs, which reduces profits. Inventory management is an important part of inventory accounting that should not be neglected.

Inventory in Multiple Territories

It may add another level of complexity for businesses that have stock stored in the United States or outside of it.

Fulfillment companies frequently have fulfillment centers in many countries. This allows e-commerce companies to distribute stock across sites, allowing them to expand geographically and connect with new consumers while lowering shipping expenses.

Regardless of where items are stored or how many locations are used, you must have complete insight into the entire fulfillment process. This is frequently done with inventory management software, which we will discuss in further detail.

Costs Associated with Inventory Auditing

Excess inventory, as well as stock-level reporting and inventory audits, must be done on a regular basis to keep your financial statements accurate and your stocks in check. However, conducting an inventory audit is time-consuming. And if it’s done manually, there’s the potential for mistakes and inventory shrinkage.

When you start or end an inventory, be mindful of the cost. Selling items without covering the costs damages their value. Changing products can affect how they’re accounted for, which may cause issues if you try selling them again.

Using Software to Manage Inventory Valuation

With inventory management software, your company can easily find missing items and monitor stock levels. Inventory management systems update all transactions in real-time so you can see inventory levels at a glance.

Inventory management software integrates several valuation techniques. Many will connect to your ecommerce platform.

Leaders get the most accurate data possible about the business. The more accurate the data, the easier it is to guide decisions toward more successful operations and profitable growth.

Inventory Valuation Methods

Let’s look at the four most popular inventory valuation methods:

1. Weighted Average Cost

The weighted average method uses an average to determine how much money goes into the COGS and inventory. To get your WAC per unit, divide the cost of goods available for sale by the number of units available for sale.

This weighted average cost inventory valuation method is often used because it’s simple and easy to understand.

A significant advantage of the weighted average cost method is that it gives a good estimate of the overall inventory value. The only major disadvantage of the weighted average cost inventory valuation method is that it can be affected by changes in cost of individual items. For example, if the cost of an item increases, the weighted average cost per unit will also go up.

This method is best-suited for companies that sell a variety of items where the products have very different costs. Inventory storage costs can be estimated by multiplying the cost per unit with the number of units in the inventory.

2. Specific Identification

With the specific identification inventory valuation method, each product unit receives a unique identifier. You can track the cost of individual units, which is ideal when you need to keep a close eye on costs.

Of the methods here, this is the most precise because it assigns a unique value to each item in stock. It’s the ideal option for companies selling homogeneous products, such as grocery items, that will not change much.

The primary drawback is net income can be manipulated on financial statements.

Inventory valuation using this method works best for companies that sell single items or small groups of very similar items.

To estimate inventory storage costs when products are not tracked separately:

Multiply the cost per unit by the number of units in stock and the products shipped.

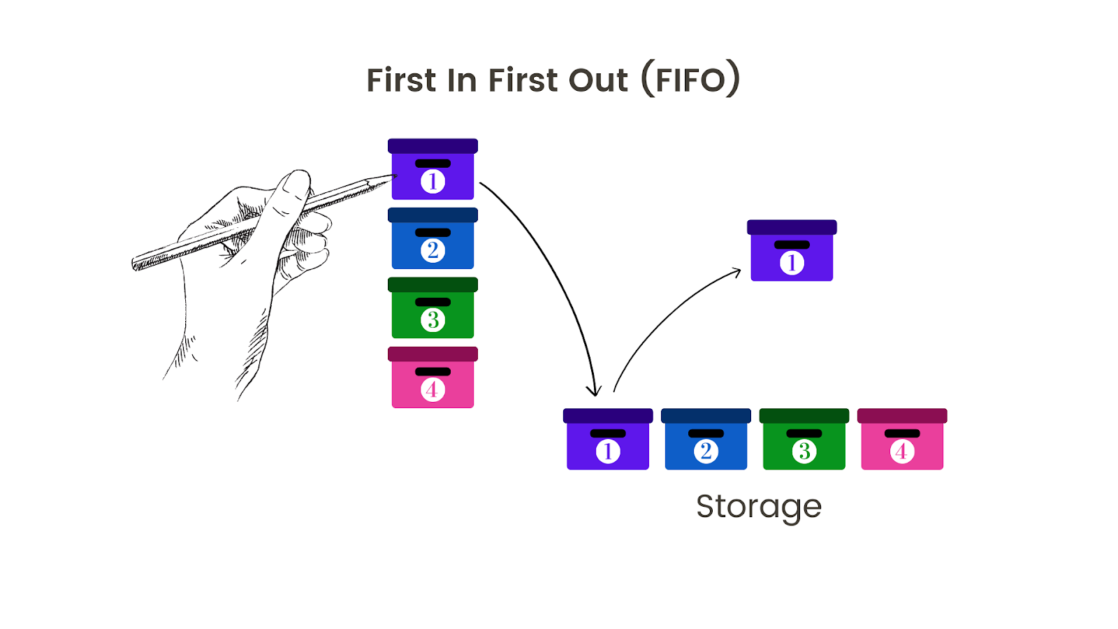

3. First In First Out (FIFO)

With FIFO valuation, you base costs of inventory on chronological order. The valuation uses the first unit purchased for the cost basis, so it’s sold for a gain.

The FIFO method assumes the first products in inventory are the first to leave. This is a more accurate method, as it avoids overstating the value of your inventory assets.

Here, you value inventory based on most recently incurred costs. It is less useful when business is slow since it doesn’t take inflation into account.

Inventory valuation using the first-in, first out method works best for companies that sell homogeneous interchangeable products with steady demand. Inventory storage costs are estimated by multiplying the cost per unit of the most recently purchased units by the number of units in stock.

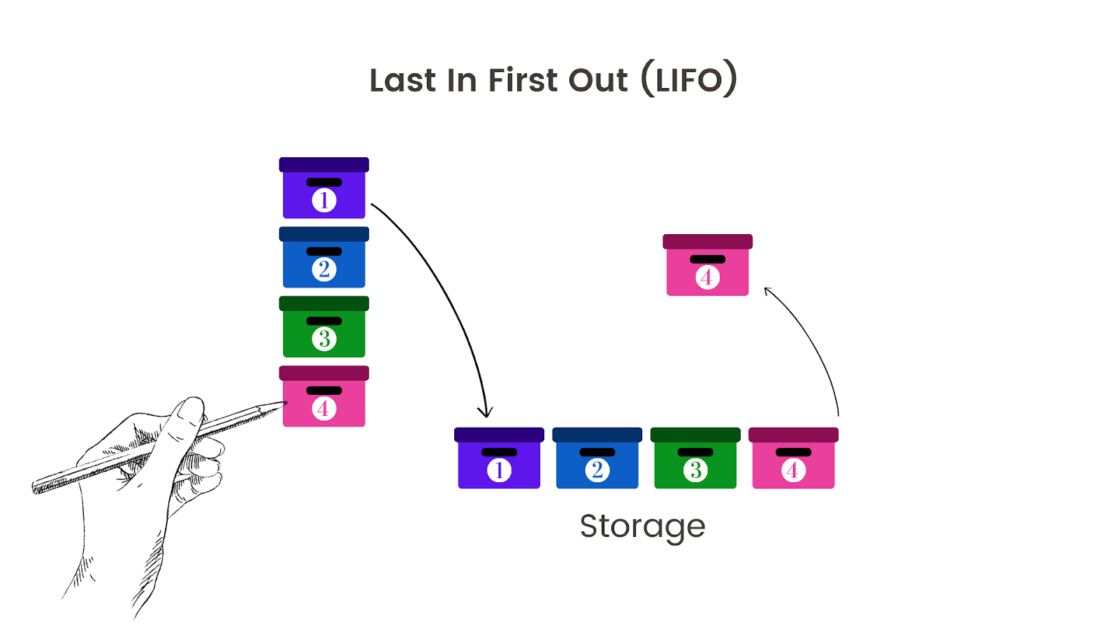

4. Last In First Out (LIFO)

With LIFO, you base costs of inventory on reverse chronological order. The valuation uses the last unit purchased for the cost basis.

The biggest benefit of LIFO is the tax advantage it offers. During times of inflation, LIFO results in a higher cost of goods sold and a lower balance of remaining inventory. A higher cost of goods sold means a smaller tax liability.

An understated inventory position may cause your working capital make look worse than it is. LIFO may cause an underestimate in your stocks. It can negatively affect profitability and growth potential.

Inventory valuation using the last-in, first-out method works best for companies that sell homogeneous interchangeable products with erratic demand.

Inventory Valuation FAQs

The selection of an inventory valuation approach has a big influence on your business. It may impact everything from budgeting to taxes, reorder quantity, and, most significantly, profit growth.

Which method of inventory valuation is the best for your business?

There’s no one correct answer here. We discuss four of the most popular inventory valuation methods for ecommerce businesses, but any of them could work for your company.

Inventory valuation methods are important because they are accepted accounting principles that help with pricing decisions, tax strategies, and other factors.

To assist with your decision making, we will outline a few scenarios and apply inventory accounting logic.

Reducing Tax Liability

If one of your business objectives is to save on taxes and we’re assuming the standard price inflation – a LIFO valuation technique might help you save money.

You are taxed on your gross profit (sales minus total cost of goods sold) and with LIFO; the liability is lower because the profit margin is lower.

Please note: this is not financial advice. This scenario could change in the event of a financial crisis or depression.

Raising Investment Capital To Expand Your Business

If you wish to borrow money, you must keep your assets as collateral. In such situations, it is preferable if the value of your stock is high, because a higher worth will provide the lender greater assurance.

If prices are going up every year, a FIFO approach will provide you with a greater closing inventory value. A LIFO approach will give you a greater value if prices are falling.

When you approach a bank for a loan, they’ll use the closing inventory line as part of their decision. Here, the method that gives you the highest inventory value is what’s best for your organization.

Attracting New Investors & Maintaining Satisfaction

Are you in the market for investors? Establish creditability with an accurate positive position on your financial statements. An ecommerce company with a high profit margin is likely to receive interest from prospective investors. Painting an accurate picture of your

Want to be sure your financial statements show steady earnings? Use FIFO during inflationary market conditions. If costs are dropping, opt for the LIFO method.

Inventory valuation is important for every company

Knowing the value of your stock allows a business to stay profitable. Inventory valuation verifies the value of goods.

The worth associated with your items affects your balance sheets and taxable income.

Balance sheets and P&L statements

To be complete, a balance sheet must include all inventory costs as an asset. COGS and assets, such as raw materials, unit costs, net income, and the value of the inventory, are all considered in the valuations.

Tax Implications

If you’re a small business owner, having an accurate inventory valuation is critical to your company’s success. You don’t want the IRS to audit you, so the appropriate valuation technique can minimize the risk of being audited and paying too much in income taxes.

Purchasing decisions

Over time, the value of many goods, such as electronics or gaming consoles, depreciates. Businesses must understand how much money they will make or lose on their current inventory in order to decide whether to restock or run a flash sale to clear it out.

You can assess whether you need to restock inventory or if you can get by with the remaining finished goods stock on hand by using the proper valuation approach.

Financial Planning & Budgeting

Inventory valuation is important for budgeting since it can help you decide whether to stay with your manufacturer or supplier, or find a new one. All aspects of your company that influence your bottom line need to be considered.

After you’ve determined how much your inventory is worth, you may choose how much money you’re willing to invest in order to make and sell the item without losing money.

Wrap Up

Inventory valuation methods are important because they heavily influence operations, from pricing decisions to tax strategies, and more. Your

To make informed decisions about your company’s finances and how much inventory to purchase, you must understand which method to use and why.

Regularly conduct inventory valuation throughout the accounting period. It not only ensures you have the right inventory you need, but is a financial health indicator.

Which of these inventory valuation methods do you find the most useful? What pros and cons have you found for these methods? Let us know!