Your eCommerce CAC (customer acquisition costs) is a vital KPI in ensuring your store isn’t just selling but sustaining profitability long term.

The question is how to calculate cost per acquisition to ensure you are doing both, then using those calculations to improve them.

It all comes down to your customer acquisition cost formula, where on the buying journey you are measuring, and the business element — which is where we come in.

This post covers everything you need to know about customer acquisition cost formulas, calculations, and benchmarks and includes some helpful tips on reducing them.

What Is CAC (Customer Acquisition Cost)?

CAC (customer acquisition cost) is the metric or eCommerce KPI by which you determine how much it costs on average to attract a new shopper to your brand. It does this by comparing the number of customers gained against the amount of money you have spent attracting them.

A lot of costs go into reaching new customers and then converting them. Some of them are more obvious (digital marketing) than others (customer service).

But ultimately, determining your CACs as a whole, by business or marketing channel, or company procedure, is vital in determining your long-term profitability.

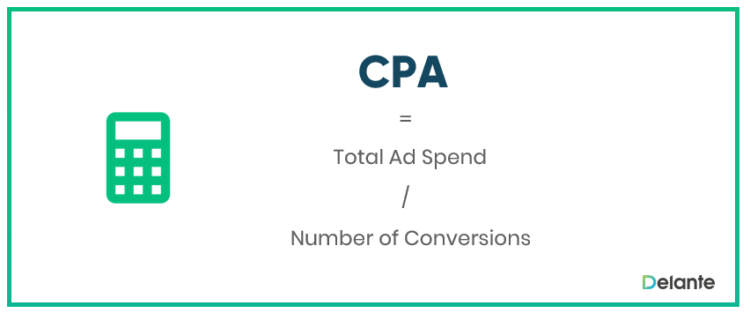

CAC vs. CPA

While CAC gives you the cost for acquiring a new customer (who shops), CPA (cost per acquisition) tells you how much each new potential customer — such as a new website click or email sign-up — costs. The latter is based on specific conversions (not always monetary or sales related) for specific actions.

For instance, let’s say you’re running a Google Ads awareness campaign with the goal to drive as many new potential customers as you can to your store who you can then retarget. Your CPA would be the total spend divided by the amount clicks you get from the campaign (conversions).

[Source: Delante]

Costs to Factor into Your CAC Formula

There are several expenses you will need to factor in when calculating your new customer acquisition costs. These include:

- Creative/production costs

- Inventory holding and upkeep costs

- Marketing costs

- Human resources/service costs

- Technical costs

Let’s take a quick look at each.

1. Creative / Production Costs

These are costs you accumulate creating content and elements. This could be creatives for ad campaigns, in-house product photography, professional video services, the money spent on acquiring freelance creatives, or the number of person-hours that go into producing and optimizing blog content.

2. Inventory Holding and Upkeep Costs

Inventory holding and upkeep costs are those expenses attributed to maintaining and optimizing your store’s inventory. This includes warehouse expenses, such as utility or storage, fulfillment services (either in-house or outsourced), handling equipment, etc. Ultimately, it is all the expenses you incur storing, managing, and holding unsold goods.

3. Marketing Costs

Your total marketing costs include all the ad spend you have incurred for eCommerce ads and other marketing for off and onsite inbound initiatives, such as TV or print ads, influencer marketing campaigns, or co-branding collaborations.

4. Workforce / Service Costs

These are team wages, freelancer costs, or any workforce or service expenses incurred that help you run your business. Whether it’s the cost of a leading Shopify app, an agency, a freelance store developer, or your in-house customer service team, they all contribute to your overall human resource expenses.

5. Technical Costs

Your technical costs are the sum of all the technology and tools your online store uses, front and backend. It can be a reporting tool, your web hosting service, the IT infrastructure at your headquarters, or the costs incurred during the upkeep of your online store.

Customer Acquisition Cost Formula and Calculation Steps

Now, let’s break down the customer acquisition cost formula and the calculation steps you need to take.

Step #1: Narrow Down the Calculation Period

First, you want to outline the period of time you wish to evaluate. This will enable you to drill down the scope of the data you need — monthly, quarterly, yearly, or totals since launch.

The time period you choose depends on your goal for the evaluation. Are you comparing two quarters after optimizing and reducing your CACs? Or are you wanting to assess overall profitability since launch?

Step #2: Calculate Your eCommerce CAC

Once you know the period you want to measure, it’s time to accumulate the data and input it into your CAC Formula. This entails totaling all your operation and marketing costs for a given period and then dividing it by the number of new customers (people that actually bought) gained for that time.

The formula itself is pretty straightforward; here is a breakdown.

CAC Formula

To calculate your CACs, you will need to take the total cost of your sales and marketing expenses and divide them by the number of new customers gained for that period.

[Source: KPI Max]

Let’s say that your online store spent $10,000 on marketing and accrued $10,000 in operating costs over six months. During this time, you could only acquire 1,000 new shoppers for that spend. Your CAC would be $20,000 divided by 1,000 customers, which equals $20.

If you spent that same money but got 2,000 new customers, your CAC would be half of that: $10.

Step #3: Evaluate CACs Against Important KPIs

Lastly, once you have calculated your store’s CAC, you will want to ensure that it aligns with your goals and KPIs. You will also want to factor in other metrics to gain an even better understanding of your growth and profitability for that period.

An important KPI to consider here is your LTV (lifetime value).

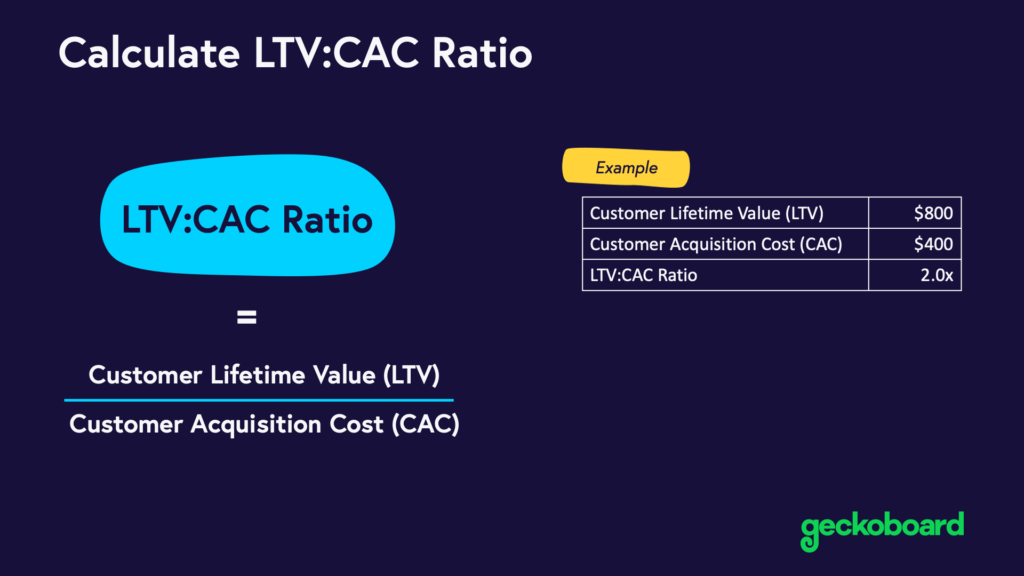

LTV to CAC Ratio: How LTV Affects Your Customer Acquisition Cost

A customer lifetime value is the metric that shows the average revenue a store makes from each customer over the course of each customer’s relationship with your brand. Sometimes referred to as your CLV (customer lifetime value), LTV is an important metric to analyze in relation to your eCommerce CAC.

The relationship between the two is called the LTV to CAC Ratio — or LTV: CAC. This ratio of how each customer is worth compared to how much you’re spending on each can help guide marketing, customer service, and backend spending.

Your LTV: CAC formula looks a little something like this.

[Source: Geckoboard]

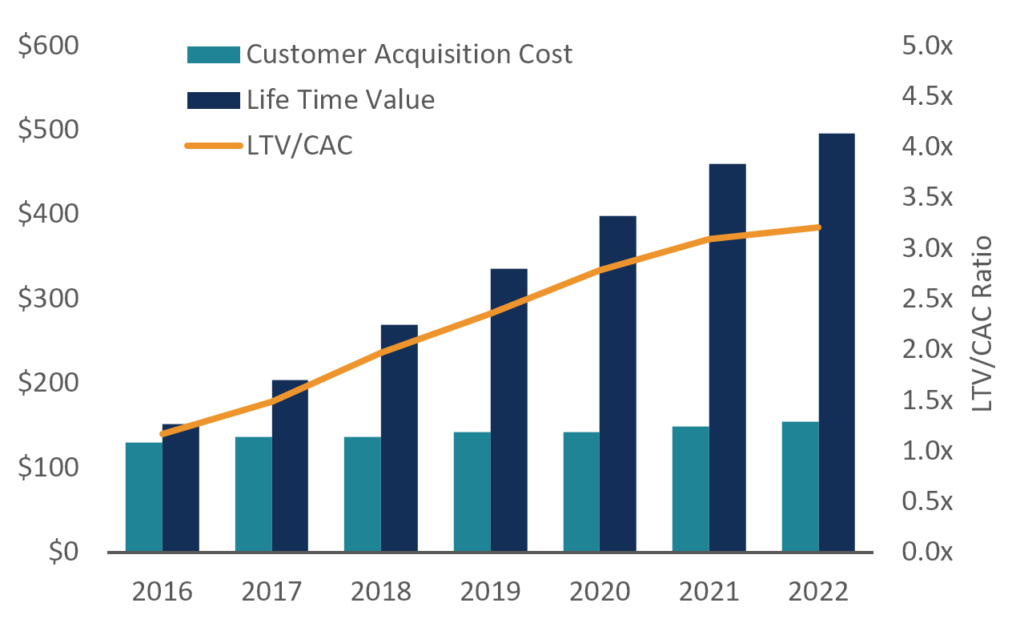

Ideally, you are looking for a steadily improving ratio where the LTV is higher than the CAC.

[Source: CFI]

eCommerce Customer Acquisition Cost Example

Let’s take a hypothetical successful apparel online retail store as an example.

This store uses a combination of dropshipping (print-on-demand products) and offsite manufacturing through one outsourced fulfillment service.

Their brand is also run leanly in terms of teams — instead, using top SaaS tools for everything from upselling to optimized merchandising.

Their marketing strategy includes:

- Content marketing (social media and SEO)

- Facebook and Instagram marketing

- Email marketing

- Giveback program marketing (and donations)

- eCommerce Google Ads

They want to assess their CACs for the quarter and therefore need to calculate the costs above and the number of new customers they had over this period (2,850) — and then factor it into their new customer acquisition cost formula.

Here is a rough idea of what their expense spreadsheet and CAC calculation would look like.

Total Expenses: $30,000

New Customers Acquired: 2,850

CAC: $10.53

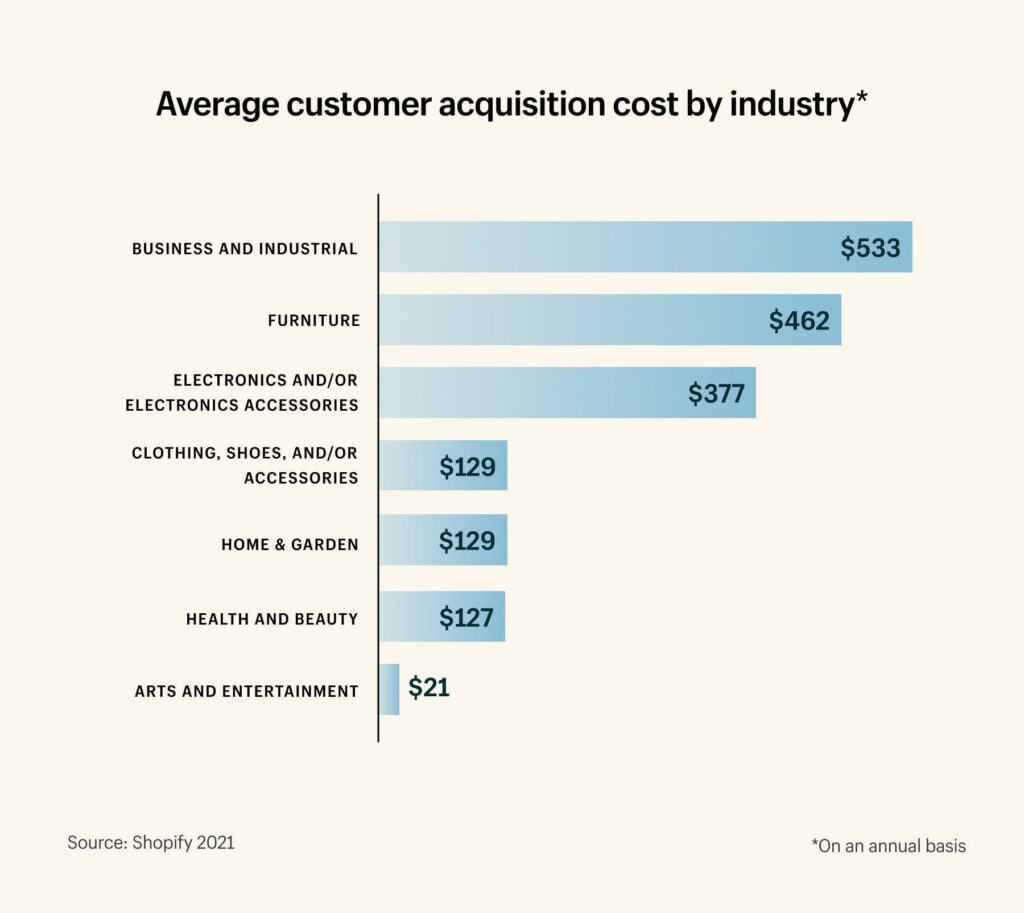

Therefore, according to their CAC calculation, this store spends an average of $10.53 per new shopper they acquired during the three months. In this case, their CAC would be well below the average customer acquisition cost benchmark for their niche.

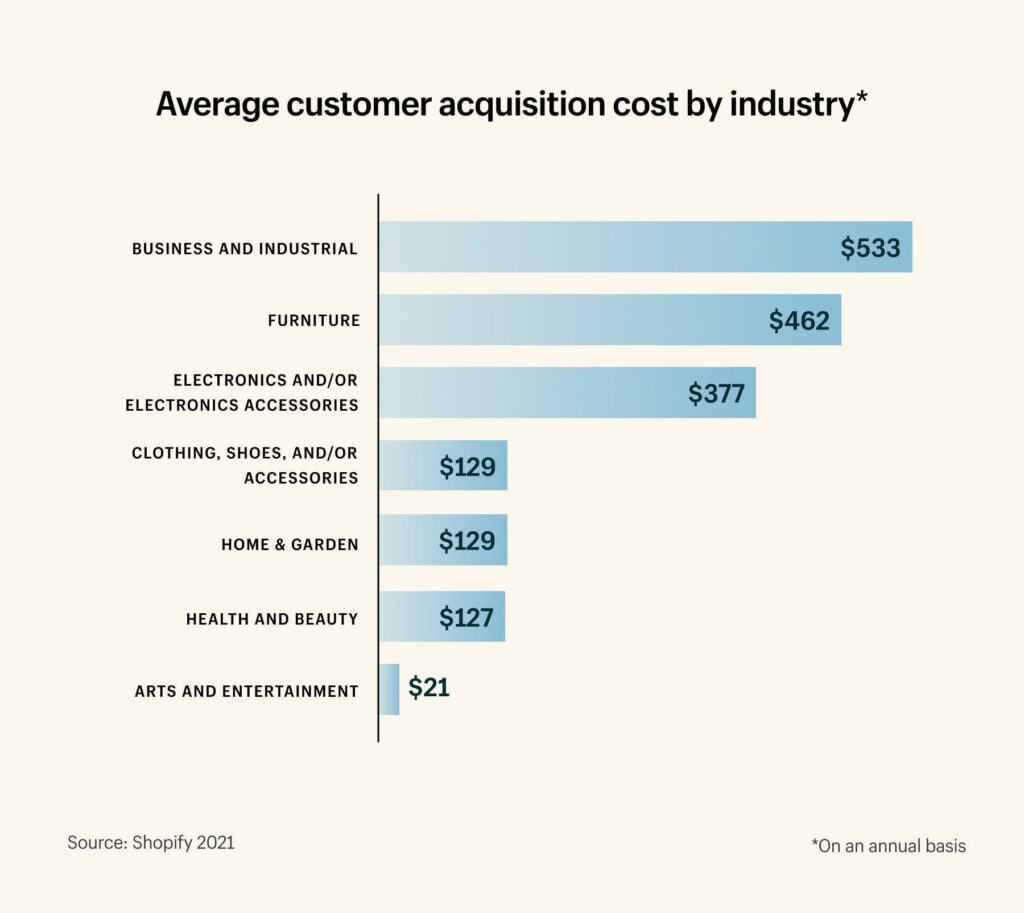

Customer Acquisition Cost Benchmarks

Average CACs will vary depending on the industry you’re selling in, the products you sell, and your target marketing. However, there are some studies, such as this one from Shopify, that will give you a rough idea of the kinds of averages you are aiming for in your niche.

Here are some of the average eCommerce CACs they found in their research, broken down per niche they are selling in.

But once again, it’s essential to keep in mind that these customer acquisition cost benchmarks are rough averages, and will differ considerably from store to store.

For instance, a luxury online jewelry store is likely to have a much higher CAC than an accessories brand aimed at students. And a store that is run very leanly will have a lower CAC than one that handles everything from manufacturing to fulfillment in-house.

That’s not to say you can’t improve your customer acquisition costs, regardless of the niche you’re selling in or the market you’re selling to.

Tips to Reduce Customer Acquisition Costs

Tips to Reduce Customer Acquisition Costs

If you’re looking to improve your eCommerce CAC, you will need to:

- Decrease operating costs

- Improve AOVs

- Optimize conversion rates

- Invest in organic marketing

- Enhance customer service

Let’s take a closer look at how you can do each.

1. Decrease Operating Costs

By lowering your overhead and operating costs, you can reduce your expenses and improve your CAC. This can include:

2. Improve AOVs

The more a new shopper spends in a single purchase, the better your CAC will be. Yes, you can increase your product prices, but to stay competitive, you want to focus on your AOVs (average order values) instead. Here are some ideas on how you can do just that:

- Improve your shopping experience

- Offer free shipping thresholds

- Include cross-sell and upsell incentives

- Improve the speed of your customer service

- Consider package promotions or bundled products

- Optimize your checkout

3. Optimize Conversion Rates

Another way to improve your customer acquisition costs is by improving your conversion rates. The better your conversion rates, the more revenue you earn, and the better your CAC will be.

The trick is reviewing and optimizing conversion rates at each stage of your eCommerce sales funnel. Here are some leading ways you can do just that:

- Make sure your messaging highlights your brand’s or product’s unique selling position

- Invest heavily into product page optimization

- Audit and optimize your store navigation and sales flow

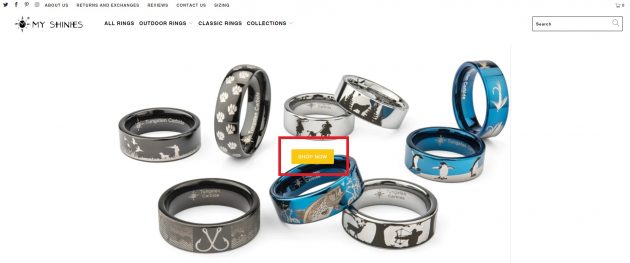

- Use CTAs strategically from the homepage to checkout

[Source: My Shinies]

You can read about these and other top tips for boosting your eCommerce conversion rates, here.

4. Invest in Organic Marketing

The more potential shoppers you have coming through organic marketing channels, the lower your CAC will be. This means you want a steady stream of organic search, social media, new customer referrals, and email marketing to keep your overall total marketing cost low.

Yes, this will increase expenses initially, but once you have streamlined your buying journey, your expenses will even out while your new customer totals increase.

5. Enhance Customer Service

Last but not least, by improving your customer experience, you can reduce your CACs.

How? The simple answer is the better the experience a shopper has, the more likely it will result in new customer success — a purchase.

And to improve your experience, you need to optimize your customer service. This means ensuring you put all those old cliches into action, such as:

- Under promising but over delivering

- Adding more value with every interaction

It also means you should be optimizing your sales funnel so it’s as seamless as possible, and investing in customer retention such as referral programs that will help increase new customers with less spend.

Final Thoughts: Focus on Growth, Not on Short-Term Costs

Here’s the thing: it is not enough to just punch in numbers into your customer acquisition cost formula and call it a day.

When you calculate CAC, you want to be sure that you’re not just focusing on a narrow time frame. Sometimes a new customer will spend a lot of time on and off your website as a potential customer you retarget before they finally convert.

In other words, the fruits of your marketing efforts take time to mature — and tweaking them isn’t a one-time thing. Instead, you want to focus on long-term growth and customer retention, seeing your LTV:CAC ratio improving yearly.

Have questions? Post them in the comments section below.

Nicole Blanckenberg

Nicole is a content writer at StoreYa with over sixteen years experience and flair for storytelling. She runs on a healthy dose of caffeine and enthusiasm. When she’s not researching the next content trend or creating informative small business content, she’s an avid beachgoer, coffee shop junkie and hangs out on LinkedIn.

Comments

comments

Powered by Facebook Comments

![How To Beat the Competition in DTC Ecommerce [Download] | Salsify](https://thegateway.net.au/wp-content/uploads/2022/11/how-to-beat-the-competition-in-dtc-ecommerce-download-salsify-768x384.png)