It’s official. We’re entering the “slower-growth new normal,” according to eMarketer.

In its 2023 Global Retail E-Commerce Forecast, eMarketer forecasts a slightly better outlook for digital retailers compared to the slumps of 2022. But the annual double-digit growth rates of the 2010s are long gone.

How will e-commerce retailers fare over the next few years following an era of volatility? It depends on e-marketers’ ability to meet consumers in the marketplaces, regions and channels they prefer most.

Global E-Commerce Growth Rates are Now in the Single Digits

It appears analysts and marketers alike must readjust their expectations for the years ahead. While eMarketer originally predicted an e-commerce growth rate of 9.7% for 2022, the industry’s growth rate only reached 7.1% last year, representing a nearly flat share of total retail. In response, analysts have reduced their forecasts for the next few years, including this year’s $6 trillion e-commerce sales prediction.

Where is this downward trend coming from? According to eMarketer, China’s economic despair is driving the decline, as it accounts for over half of the global total.

But the news isn’t all bad. While lackluster, the economic environment is expected to stabilize this year with retail growth to follow. In fact, global sales will still increase by $483 billion this year, which is more than the entire US market in 2017.

The Gap Between E-Commerce and Retail Has Narrowed

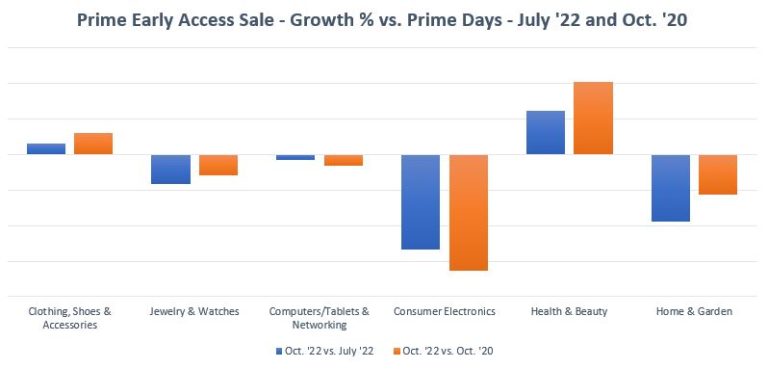

Last year, consumers more than made up for in-store retail’s nearly nonexistent 2020. As pandemic-era regulations faded, consumers headed back to stores in droves, driving the gap between e-commerce and retail sales growth to just two-tenths of a percentage point.

E-commerce lost ground in countries around the world last year, particularly in Western Europe and East Asia. Driven down by poor economic conditions, the war in Ukraine, inflation, the energy crisis, exchange rate abnormalities and lower in-store prices, Western Europe’s overall e-commerce market decreased by 3.9%. Likewise, “zero-COVID” pandemic control measures debilitated consumer spending in China last year.

This certainly doesn’t mean e-commerce has lost its appeal to consumers. Online retail will still outperform brick-and-mortar, but to a lesser degree. It’s up to e-commerce retailers to reach audiences with the most targeted strategies in the most promising markets.

Asia-Pacific Makes Up 70% of the Top Countries for E-Commerce Sales Growth

Of the top 10 countries for e-commerce sales growth in 2023, seven are in Asia-Pacific. The Philippines and India top the list for the next three years, with Malaysia and Thailand hovering in the top five.

Digital shoppers in India will spend $21.7 billion more this year than last year, while Indonesia’s spending will increase by $16.19 billion. If your e-commerce strategy is global, eMarketer recommends seeking out these hotspots, in addition to Mexico and Brazil. These four emerging markets promise significant scale that will grow by double digits this year.

Limited to the US? That’s ok too. Even though growth rates are lower, the mature US market has become more reliable than China. In fact, eMarketer predicts the US is set for higher ecommerce growth than China for many years to come.

Adapt to Changing Markets with Multichannel Agility

The most important takeaway from eMarketer’s findings? Readjust your expectations for the years ahead and refocus on safe bets. It’s also more important than ever to find ways to reduce friction and increase agility.

“In order to increase their agility and address an unpredictable macro environment, many brands and retailers are leaning even further into their digital strategy and focusing on e-commerce innovation to better use data for real-time decision-making,” says Peter Elmgren, Chief Revenue Officer at CommerceHub.

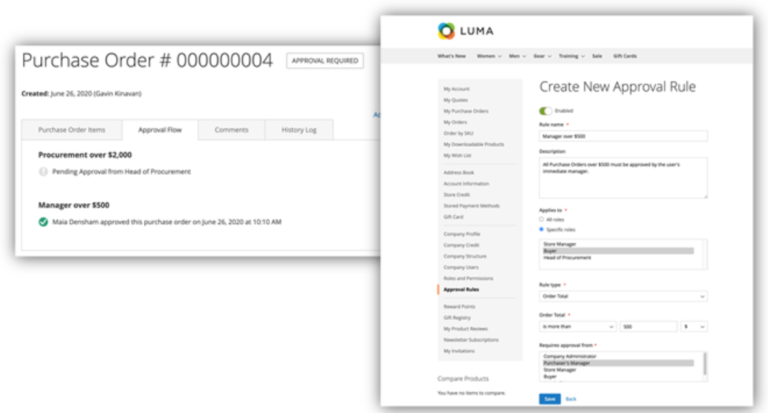

Together, CommerceHub and ChannelAdvisor offer the industry’s leading solution for expanding into new markets, launching new channels and executing advanced e-commerce strategies.

Download eMarketer’s full 2023 Global Retail E-Commerce Forecast for more data points, charts and details about growth in global markets.