- Posted on

- • October 17, 2019

- Ecommerce Resources

The modern online shopper expects a checkout and payment processing experience that is fast, convenient, and safe. Failing to provide an experience that meets these expectations can cost online sellers in both sales and reputation.

There are plenty of payment technologies and solutions out there, but it can be difficult to nail down exactly which ones are right for your online store. In this article, we’ll take a look at the different kinds of payment technology available to merchants and explore the benefits and best use cases of each.

Ecommerce Payment Solutions

Payment Gateways and Merchant Accounts

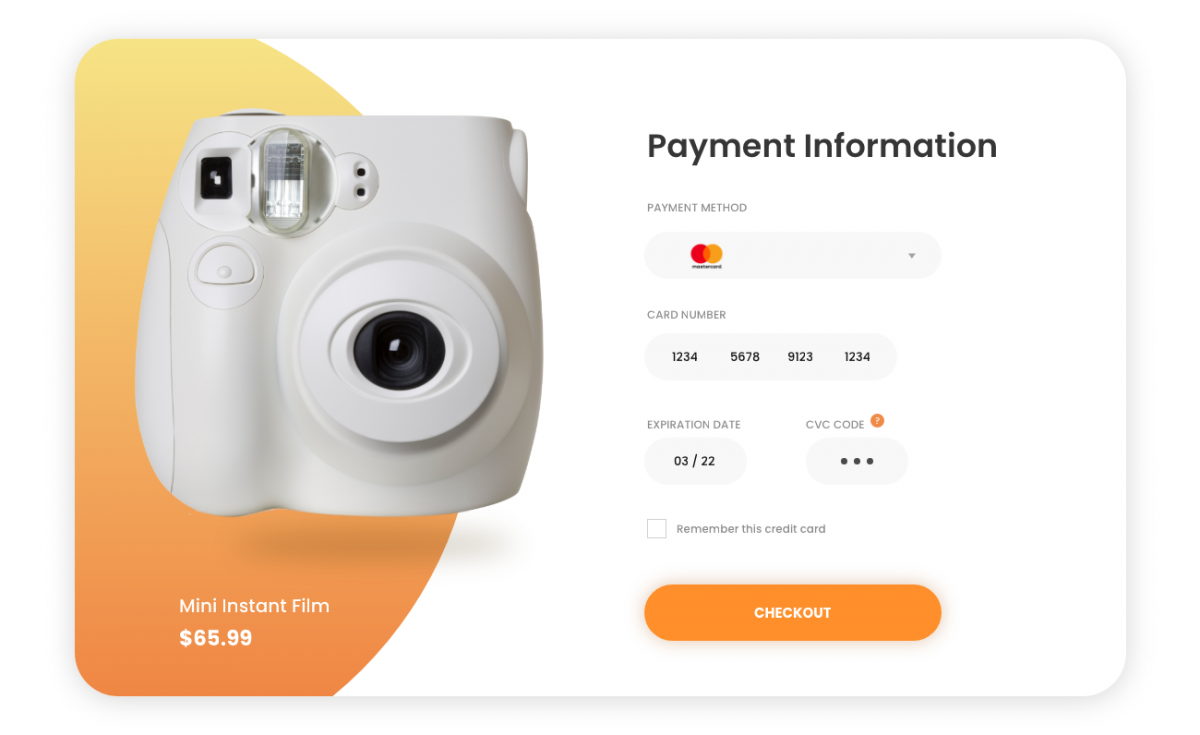

Accepting direct credit card payments on your site requires both a payment gateway and a merchant account. The payment gateway is what authorizes the transaction and the merchant account is what receives and holds the payment prior to it landing in your bank account. A robust payment gateway will enable you to offer your customers several payment options (credit cards, debit cards, e-checks, etc.), giving them the ability to use their preferred payment method. You can get your payment gateway and your merchant account from different vendors or you can opt for an all-in-one payment gateway that provides both services.

The advantage of an all-in-one solution is in the ability to pay one low rate to a single vendor for your gateway and account services. Having your payment gateway and merchant account supported by different vendors means separate (and potentially greater) processing fees but can be preferable if your payment gateway doesn’t accept payments for some of your products.

See Payment Gateways

Credit Card Vaults and Wallets

A credit card vault is a service that encrypts and securely stores your customers’ credit card information. Vaults allow online sellers to accept payments without having to handle and store credit card information themselves, reducing liability exposure and simplifying PCI compliance. Credit card vaults make payments easier and more convenient for customers, allowing them to reuse their stored (and encrypted) payment methods by accessing a secure digital wallet.

Miva considers a secure credit card vault to be an essential part of a full-featured ecommerce platform. This is why MivaPay, Miva’s powerful payment vault solution, comes standard with Miva. Learn more about MivaPay.

See Credit Card Vaults

Alternative Checkout

With an alternative checkout, you can allow customers to use a third-party payment method that they are familiar and comfortable with. This can help you put customers (and especially first-time purchasers) at ease and encourage them to complete their purchase.

See Alternative Checkouts

Financing

Some sellers, especially B2B merchants and retailers offering “big ticket” products, may also improve purchase completion rates by partnering with ecommerce financing providers and offering these as a payment option during checkout.

See Ecommerce Financing

Finding the Right Fit for Your Business

Ideally, you should try to offer your customers as many payment options as possible. This can help clear up common objections and minimize friction points during the shopping and checkout process. The right solutions are the ones that make purchasing from your site easy, convenient, and safe for your customers.

Payment Security: Protecting Your Business and Customers

Fraud and other forms of cybercrime are a top concern for many merchants these days. Fortunately, there are plenty of security solutions out there that can help you protect your business, reputation, and customers.

See Fraud Prevention Solutions

Types of Fraud to Look Out For

- Carding: “Carding” describes a form of credit card fraud in which automated bots attempt purchases using stolen credit card information. Using a secure credit card vault can help prevent this.

- Skimming: Skimming attacks exploit website vulnerabilities to steal credit card numbers. These attacks can be thwarted through the use of 2-factor authentication and browser verification.

- “Friendly” Fraud: This type of fraud occurs when a customer purchases an expensive item and then claims they never received it in hopes of receiving a refund. Merchants can prevent friendly fraud losses with good tracking and shipping visibility. A thorough and strict refund policy can also deter potential fraudsters.

Miva Preferred Payment Technology Partners

We partner with the best to ensure that our clients have the stability and security they need to be successful. This standard is the foundation of our expansive ecosystem of payment partners, all of which integrate seamlessly with the Miva platform. Our Preferred Partners offer payment processing, fraud prevention, alternative checkout, and financing solutions to meet the needs of every business.

All-in-One Payment Gateway + Merchant Account

Braintree

Braintree is an all-in-one solution for accepting and processing ecommerce payments. Braintree delivers an innovative payment experience with advanced security, digital wallet functionality, and more.

Authorize.Net

Authorize.Net, a Visa solution, provides secure, reliable payment gateway solutions. These solutions help merchants simplify PCI compliance, prevent fraud, accept alternative digital payments and e-checks, and protect customer payment information.

Authorize.Net can be used as a gateway alongside a merchant account supported by another vendor.

Chase

Chase offers secure and reliable payment processing solutions that help merchants improve how they run and grow their businesses. Key features include comprehensive reporting tools, chargeback management, fraud prevention, and 24/7/365 in-house customer support.

Square

Square helps businesses to easily sell online and in person by providing more payment flexibility for customers and creating more conversion opportunities for online sellers. Key features include fraud detection, chargeback protection, and real-time sales data.

APS Payments

APS Payments, a REPAY company, is an all-in-one payments provider that offers omnichannel B2C and B2B integrated payment solutions, low credit card processing rates, simplified PCI compliance, and level 3 credit card processing for online sellers.

Credit Card Vault/Wallet

MivaPay

MivaPay is a secure credit card vault that works with your payment gateway to simplify PCI compliance and protect your customers’ payment information.

Fraud Prevention

Signifyd

Signifyd leverages machine learning and big data to shift fraud liability away from merchants, helping them increase sales and revenue.

Kount

Kount’s AI-driven fraud protection solution helps merchants reduce chargebacks, accept more legitimate orders, and prevent mobile fraud.

Alternative Checkout

PayPal Checkout

PayPal checkout is an alternate checkout service which enables merchants to accept credit card, debit card, and PayPal payments on their websites.

Amazon Pay

Amazon pay is an alternative checkout solution that offers customers a trusted and recognizable checkout that uses information stored in their Amazon account.

Apple Pay

Apple Pay gives customers using Mac computers, iPhones, Apple Watches, and iPads the convenience of single-touch purchasing.

Financing

PayPal Credit

PayPal Credit offers merchants an easy way to extend financing options to customers, boosting sales and increasing average order size.

Affirm

Affirm offers a pay-over-time solution designed to help improve customer experience and increase conversions. Affirm offers flexible payment options and assumes all chargeback and fraud risk.

Apruve

Apruve provides a simple way to extend net terms to business buyers, providing risk-free payment in 24 hours.

Rumbleship

Rumbleship enables auto-debit invoicing for merchants to allow risk-free net terms for wholesale buyers.

Speciality Payment Services

UPS i-parcel

UPS i-parcel offers a complete solution for international shipping, providing total landed cost during checkout, currency conversion, fraud protection, and international payment options.

Zonos

Zonos helps merchants connect with and better serve international shoppers. Key features include clear duties, accurate international shipping rates, and localized currency.