[The original post had data issues–primarily impacting three categories–that have been corrected in this version.]

With day one of Amazon’s Prime Day in the books, let’s take a quick look at the results. Which categories are winners and which are losers? In short, there are no losers when you look year over year in June. However, two categories are down from day one on Prime Day 2020.

Before looking at the results, please note the following points:

- This data is based on GMV aggregated across our entire customer base globally and includes GMV from all channels (not just Amazon), since many marketplaces and retailers run promotions that coincide with Prime Day.

- The data presented below highlights a subset of marketplace categories. Because marketplaces have different category structures, the data is presented using categories that have been standardized by ChannelAdvisor.

- This data is not a proxy for overall e-commerce activity or the performance of any individual business, including ChannelAdvisor or any individual marketplace.

- The data shown below is based on comparisons of GMV, as noted, and is expressed as percentage growth, but with actual numbers removed.

- All calculations are done in USD. Global currencies are converted to USD using the conversion rate on the day of the order. These results are not normalized to account for fluctuating exchange rates. Please note that volatility in various currencies may slightly impact these trends.

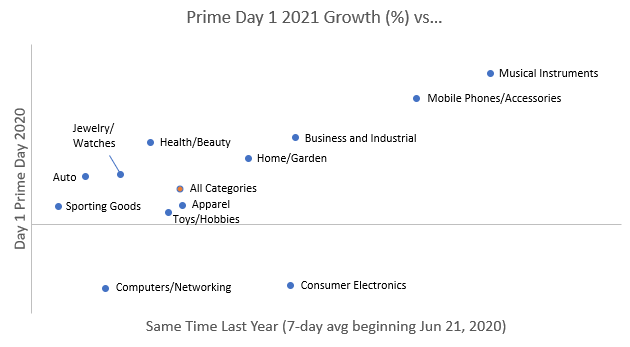

The chart below illustrates category growth on day one of Amazon Prime Day compared to two time periods from last year. On the x-axis, this year’s growth is calculated relative to the average daily GMV for the week of Jun 21, 2020. On the y-axis, we compare growth on day one this year from day one of Amazon Prime Day 2020 (Oct 13, 2020). With the COVID impact on e-commerce in full swing this time last year and the different time periods for Amazon Prime Day, we thought both perspectives were worth investigating.

On day one of Amazon Prime Day, all of the major categories grew year-over-year from June 2020 despite the fact that e-commerce was on fire last year at this time. Most of the categories grew on day one from Prime Day 2020 to Prime Day 2021, the exceptions being Computers/Networking and Consumer Electronics. However, given the overall online growth in these categories, we doubt that many are fretting the results of a single day. Of the larger categories examined here, Mobile Phones/Accessories and Musical Instruments were the day one standouts.