For any business, credit card processors are a critical component. In the ecommerce realm, it becomes even more crucial since you are not accepting payments in person. Since there are so many different credit card processing companies to choose from, finding the one that works best for your business can be overwhelming.

In this blog post, we’ll take a look at what you should consider when choosing between credit card processor companies and the top 13 choices.

What are Credit Card Processors?

Credit card processors is a third party between your business and your customers’ credit card company. You may also hear it referred to as a payment processor (not to be confused with a payment gateway). You cannot accept credit card payments without one.

The processor analyzes and transmits transaction data, then sends the relevant information to the issuing bank, and authorizes the transfer of funds between buyer and seller.

Each company will have its own pricing structure, so what may be the cheapest option for one business may be more expensive for another. The most affordable option depends on your sales volume, industry, and the typical size of your transaction.

What to Consider When Choosing

No two companies are alike, and as your business evolves, you may need to switch providers. As you make a choice, consider:

Monthly Fees

Some companies will charge a flat monthly rate just to access their services. If you have a high monthly fee on top of your payment processing fees, these costs can add up quickly.

Transaction Fees

Every processor will charge a fee for each transaction you process. This fee is typically based on the transaction amount. You will pay a percentage of the transaction plus a small fee for each one that is processed. Many companies offer reduced transaction fees once you reach a certain volume of online payments every month.

Interchange plus rates may fluctuate but offer balanced and fair pricing. The interchange fee is different from one card to the next. The more premium the card is, the higher the interchange rate. Credit card processors charge a small markup to cover the interchange fees.

Volume Per Month

Your monthly credit card sales volume may heavily influence your pricing. Some providers are meant for high-volume merchants, while others are efficient for ecommerce businesses that are just getting started. Your business type may also influence your risk and credit card processing volume, limiting your choices.

POS Features

Point-of-sale (POS) features aren’t necessarily that important for an ecommerce business, but for physical store locations with an online store, they are crucial to accept credit cards. Not all payment processors accept all types of credit card, so that’s another thing to think about.

If you need a POS system to process in-person transactions, make sure it offers everything you’re looking for. Do you want to be able to accept other payment methods such as digital wallets like Apple Pay, Google Pay, or Amazon Pay? Do you want to be able to accept gift cards or track inventory between your physical store and ecommerce website? These are all things to think about when evaluating your options.

Contracts

Contracts aren’t always a bad thing, but they may be restrictive. If your business is in a growth period where circumstances frequently change, locking yourself into a contract may mean paying more than you need to process payments. It may also mean early termination fees if you decide to break it to switch to another provider.

Fraud Protection Services

Credit card fraud is a major concern for retailers and can really take a toll on your profit and your status as a trustworthy business. Pay close attention to the fraud protection services companies offer – you want a processor that will flag and deny risky transactions. Make sure they’re PCI compliant, ensuring data remains encrypted during the transaction and storage.

1. Square

Square is one of the most popular options because it offers free POS software, a free online store, and a free mobile card reader alongside flat-rate pricing. It is one of the most affordable credit card processing options on the market today for smaller businesses. The free POS software allows you to accept in-person payments if necessary. Retail and restaurant plans are available for companies that need additional features.

Ecommerce transactions cost 2.9% + 30 cents.

Pros

- Free POS software and mobile reader

- No monthly subscription fees

- No PCI compliance fees

- No setup/activation fees, no refund or chargeback fees, and no early termination fees

Cons

- 24/7 customer support is only available for paid POS plans

- Some businesses may find the pricing is more expensive than an interchange-plus pricing model.

- Not suited for high-risk merchants

2. Stripe

A popular Square alternative, Stripe’s flat-rate pricing is attractive for many small business owners. You can find payment service providers with lower fees. Still, because it lacks many other fees, offers flexibility, and various other payment tools, it is difficult for many small businesses to find something better. Stripe includes a suite of features, including invoicing, billing, and tax collection.

Ecommerce transactions cost 2.9% + 30 cents per transaction. International transactions are charged an additional 1% plus another 1% for currency conversion, if necessary.

Pros

- No setup fees

- No monthly subscription fees

- Accept payments in more than 135 currencies

- 24/7 phone, chat, and email support

- Over 450 extensions and platforms available for integration

Cons

- Won’t work well for high-risk businesses

3. Helcim

Helcim is an excellent choice for small businesses that need a low rate and don’t want any subscription fees. The interchange plus fee structure ensures a cost-effective option, particularly for companies with high sales volume. The website clearly displays pricing information with volume discounts. These are applied automatically as the volume of payments you process increases.

You get a customized rate based on your volume of credit card transactions. The average rate for online transactions is 2.38% plus 25 cents per transaction.

Pros

- No monthly subscription fee

- No setup fees

- No cancellation fees or contracts

- No PCI compliance fees.

- Includes customer management and inventory management tools

- Easy sign up with online approval

Cons

- Not necessarily the best option if you process less than $25,000 in credit card payments every month

- Won’t work well for high-risk merchants – those that are at a higher risk for chargebacks or fraud

- Doesn’t offer 24/7 support

- Only one plan to choose from

- Only one type of hardware for physical businesses

4. PayPal

One of the most widely known and easy-to-use payment processors, PayPal is best suited for small businesses with a low transaction volume. Use it to accept all major credit cards (Visa, Mastercard, Discover, and American Express) and debit card payments via the PayPal Here app. You can get a free card reader for mobile devices for in-store transactions or pay $79.99 for a more advanced card reader that allows customers to make contactless payments (tap to pay).

It integrates with several POS systems, Constant Contact, Shopify, and QuickBooks.

Pros

- Free, easy account setup

- No contracts or monthly fees

- In-store customers can use mobile wallet payment options

Cons

- Not ideal for a high transaction volume

- May be subjected to holds if your account is suspected to be associated with fraudulent activity

- No 24/7 phone support

5. Stax

Formerly known as Fattmerchant, this Credit card processing company Uses a membership pricing model alongside a flat-rate transaction fee. This pricing structure is best suited for high-volume businesses that would otherwise pay more than $99 per month in percentage markups and fees associated with the interchange pricing structure that many competitors use.

Pricing starts at $99 per month with interchange fees + 15 cents for businesses that process up to $500,000 per year.

Pros

- No contracts

- 24/7 support

- Add-ons available, such as same-day funding and custom branding

Cons

- Not the best credit card processing option for low-volume businesses

6. Clover

Clover offers credit card processing services on a subscription basis, with fees ranging from $9.95 to $69.95, depending on your plan. It’s ideal for small businesses with less than $50,000 in annual credit card transactions.

Pros

- Competitive credit card processing fees

- No early termination fee or cancelation fees

- 24/7 customer support is available

Cons

- Daily limits on instant transfers

- POS only works with Clover, no other merchant account providers

- Monthly fees are per device

7. PaymentCloud

PaymentCloud is one of the best credit card processors for high-risk industries. They’ve been in business since 2015 and offer API integration with many ecommerce platforms, including WooCommerce and Wix.

Pros

- Dedicated account manager

- Easy setup

- Quick application approval

- Next business day funding

Cons

- Pricing information not displayed on the website

- Price varies by risk

- May be charged an early termination fee

8. National Processing

National Processing is a merchant services provider with an interchange plus fee structure. If your business process is at least $10,000 a month in payments and National Processing can’t beat current rates, you may qualify for a cash reward.

National Processing offers plans for restaurant, retail, subscription-based businesses, and online businesses. The e-commerce plan is charged at 9 95 per month with interchange Plus to 9% and 15 cents per transaction. Credit card processing rates may vary.

The subscription plan is charged at $59 per month with interchange rates + 9 cents per transaction. Rates may vary. The subscription plus plan is billed at $199 per month with interchange Plus rates and 5 cents per transaction. Rates may vary.

Pros

- No monthly minimums

- Options for high-risk merchants

- No contracts or termination fees.

- All plans include free reprogramming of existing hardware and a mobile credit card reader for mobile payments.

- 24/7 support

Cons

- Not easy to find other fees, such as PCI compliance fees

9. Payment Depot

Payment Depot is another merchant account provider operating with an interchange Plus price structure. It is different from others on this list because transaction fees are based on your plan rather than the terminal you use. Payment Depot offers and 90-day trial, so if you cancel your account before the end of your 90 days, you will receive a refund of your annual membership fee.

All plans include free programming for any existing equipment you may own and a free virtual terminal that allows you to key in credit card numbers when the card is not present.

Pricing ranges from 79 to $199 per month. Transaction fees are at interchange-plus rates and range from 7 to 15 cents per transaction, depending on your plan.

Pros

- Free reprogramming of your existing terminal, if you have one

- 90-day trial

- Free virtual terminal

- No cancellation fees

- 24/7 support

Cons

- The bottom two plans have maximum processing limits

- Will not work for high-risk merchants

10. Payline Data

Payline Data provides merchant accounts with interchange-plus pricing. There are two plans to choose from, one tailored to brick-and-mortar businesses and the other for ecommerce merchants. It is an option for high-risk merchants, like fantasy sports, tobacco, or online gaming niches.

Payline data plans cost $$20/month plus 0.4% and 20 cents per transaction. You must have a monthly minimum of $25 in processing fees.

Pros

- First month free

- No long-term contracts or cancelation fees

- No PCI compliance fees

Cons

- Monthly minimum requirements

- No 24/7 phone support

11. MerchantOne

MerchantOne offers the lowest monthly fee among those in the credit card processing industry that operate on a subscription model. At just $6.95 a month, you can expect processing fees that range from 0.29% to 1.99%.

Ecommerce merchants get access to a virtual terminal and can use it to take credit or ACH payments. You can also access 175+ shopping card integration, buy now buttons, store credit card information for customers, and have the option to add gift card support.

Pros

- Dedicated account manager

- Low monthly fee

- Plenty of hardware options for brick and mortar stores, too

Cons

- Some fees are not disclosed online

- Need to call for a quote and pricing

- No online help material

12. Paysafe

Paysafe is the parent company of Neteller and Skrill, two companies known for e-money transfers. PCI compliance is included at no fee.

Pros

- Supports e-cash payments

- Send invoices and make recurring payments

Cons

- Pricing information isn’t disclosed on the website.

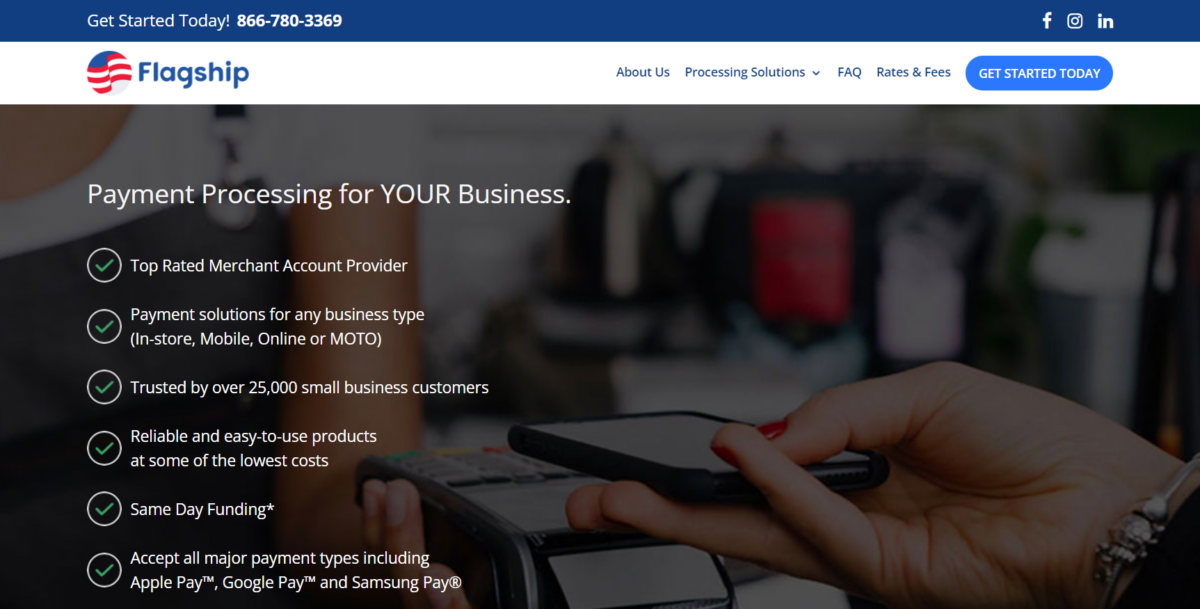

13. Flagship Merchant Services

Flagship Merchant Services is a credit card processing solution that offers a month-to-month agreement with no cancelation fees. Hardware is available for those who sell in-person through Verifone and Clover. Free equipment is available if you sign a three-year contract, but many business owners want to avoid a long-term contract, especially in the beginning.

Pros

- No long-term contracts

- Can choose between interchange-plus pricing and tiered fee per transaction rates

- Dedicated account manager

Cons

- Charges PCI compliance fee – many processors include this

- Pricing isn’t available on the official website

- Customer service is only available during business hours in Birmingham, Alabama

FAQs

Start Taking Credit Cards Today

If you want to start an ecommerce business, you must be able to accept online payments. We hope this information on credit card processing companies helps you choose the partner you want to support your venture.

![Set Up Your Online Store for 2021 Success [eCommerce January Checklist]](https://thegateway.net.au/wp-content/uploads/2021/02/set-up-your-online-store-for-2021-success-ecommerce-january-checklist.png)