Digital Commerce 360 just released its 2022 B2B Marketplaces: Growth and Trends report detailing the state of business marketplaces and how they’re shaping the future of business-to-business (B2B) digital commerce.

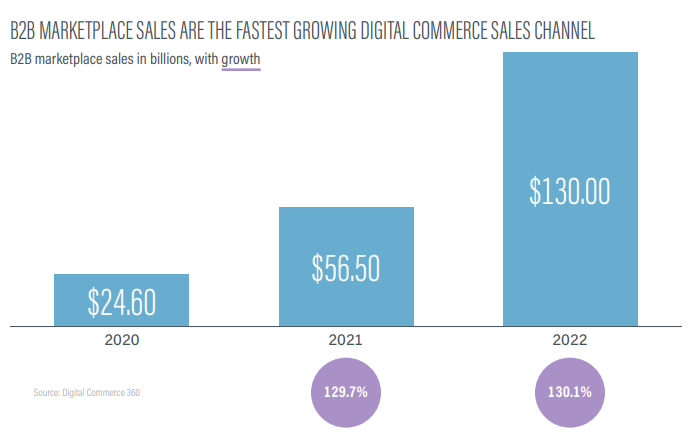

The biggest takeaway? Despite the longstanding love/hate relationship between B2B e-commerce and marketplaces, B2B marketplace sales are now the fastest-growing digital commerce sales channel.

Though B2B marketplaces like Amazon Business or Alibaba were once a blip on the B2B e-commerce landscape, digital-first buyers now seek out marketplaces to source and purchase their company goods and services, thanks in part to ongoing supply chain disruption due to COVID-19.

The report presents several key findings, such as:

- Sales on B2B marketplaces increased 131% to $56.5 billion in 2021, and they’re projected to keep pace toward $130 billion in 2022, making them the fastest-growing e-commerce channel.

- As a result of COVID-19, B2B buyers took to the internet, with 57% buying “somewhat more” or “significantly more” on marketplaces since 2020. As a result, 26% of B2B buyers now say more than half of their buying is done on marketplaces.

- Just three years ago, Digital Commerce 360 was following 75-100 marketplaces. Today, the company holds metrics and analyses for 400 commercial and vertical-specific marketplaces across 18 countries.

- Amazon Business remains the single most dominant B2B marketplace with a predicted gross volume of $41.5 billion this year.

The report also features insights from key industry experts, including ChannelAdviser’s Product Marketing Manager Bradley Hearn, around the importance of a holistic approach to B2B companies’ marketplace efforts.

“Sellers must have centralized strategies for repricing, product data optimization and syndication, advertising, analytics and connections to fulfillment and shipping partners,” said Hearn. “A centralized, multichannel commerce platform helps you expand more efficiently by connecting to new sales channels, managing product content and data feeds, advertising and managing inventory and orders.”

Readers can also view case studies from B2B marketplace ShapeConnect and HVAC distributor Watsco, as well as Unilever, one of the world’s biggest and oldest consumer brand manufacturers. B2B e-commerce is now a digital growth driver for Unilever, with sales on their B2B platforms growing 69% already in 2022.

The B2B marketplace movement is here to stay, judging by the growing relationship between buyers, sellers and marketplaces. More than that, business marketplaces have become a digital commerce staple that B2B brands and retailers can’t afford to ignore.

Download the full 2022 B2B Marketplaces: Growth and Trends report to learn more.

![Counting Down the 9 Top eCommerce Blog Posts [2020]](https://thegateway.net.au/wp-content/uploads/2021/02/counting-down-the-9-top-ecommerce-blog-posts-2020.gif)