For most brands and retailers, the 2021 holiday season is still far from over. There are plenty of advertising budgets to manage, promotions to deploy, and orders to fulfill. But with Green Monday — the second Monday in December and, traditionally, the last major shopping holiday of the season — behind us, the holiday shopping season is finally coming into focus.

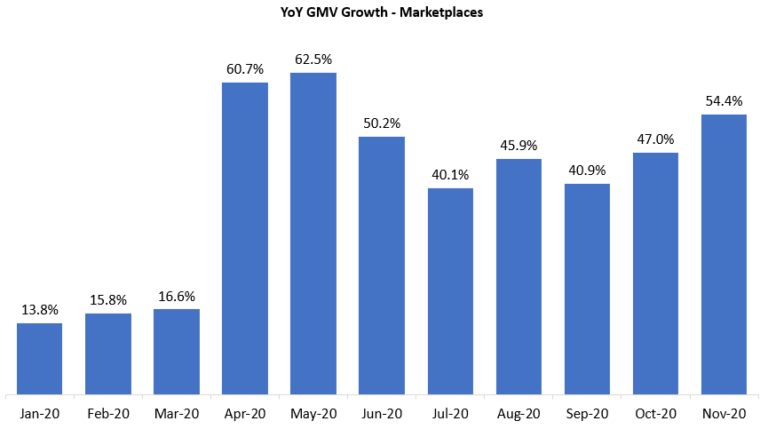

As expected, the overall 2021 holiday season is on track to break new records. But as we speculated in the past two blog posts, most consumers didn’t wait for the traditional Cyber Five days to begin their holiday shopping. According to ChannelAdvisor data, year-over-year GMV was pulled slightly forward into the weeks leading up to Thanksgiving, compared to a flatter Cyber Five week.

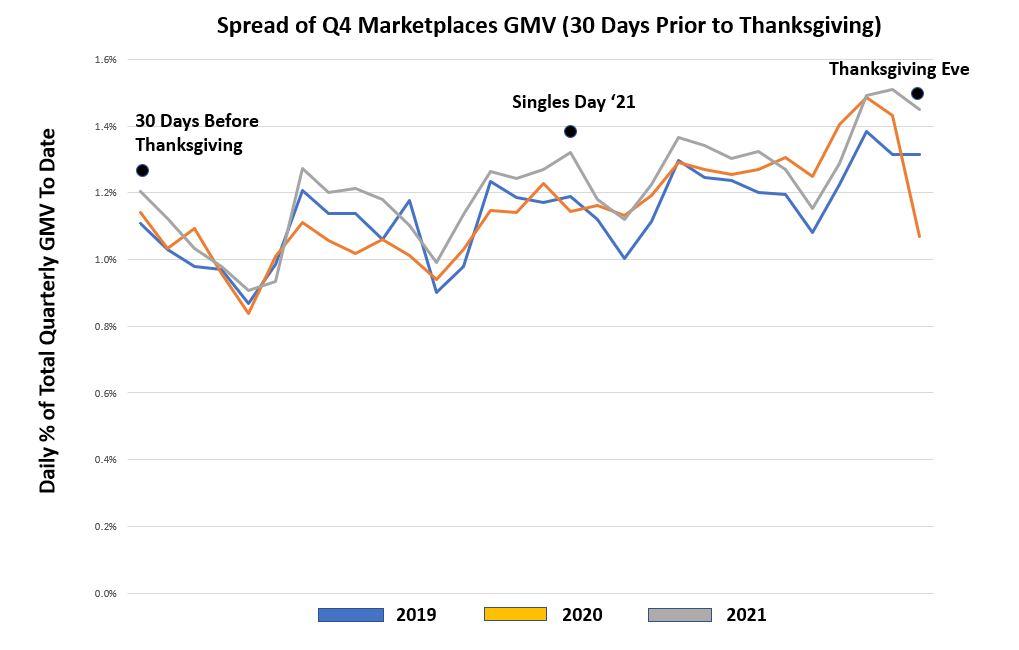

Though it wasn’t a dramatic shift, we certainly saw some of the sales traditionally reserved for the Cyber Five distributed across November — and even October. In this first graph, you’ll see a snapshot of how this quarter’s GMV has been distributed by viewing the 30 days leading up to Thanksgiving for the past three years.

On average, the month leading up to Thanksgiving made up a slightly larger percentage of Q4’s GMV in 2021 than it did in 2020 or 2019.

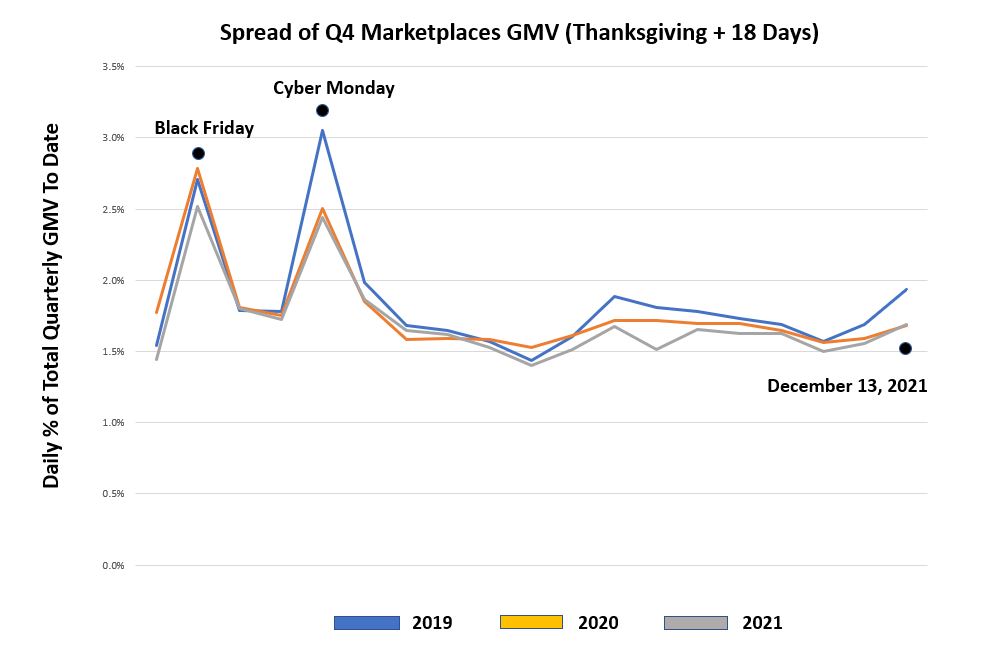

Conversely, if we look at GMV between the Cyber Five and Green Monday, daily percentages in 2021 are lower than past years. Below is a snapshot of how the quarterly GMV to date was distributed from Thanksgiving through December 13 (this year’s Green Monday), aligned with the same 19 shopping days in the previous two years.

The daily percentage of quarterly GMV for 2021 is lower during these dates, further illustrating that GMV was, in fact, pulled ahead of the traditional peak holiday shopping period. Again, it’s not a dramatic shift, but it will be interesting to see how much of this trend continues in coming years or whether it can be attributed to global supply chain delays and the ongoing pandemic.

Category Data

Please Note: The gross merchandise value data presented below (“GMV”) is based on aggregate sales activity through our platform on marketplaces across our entire customer base globally. The growth percentages are based on “same store sales” (i.e., only accounts generating sales in both time periods were factored into the calculations) for Q4, ending two weeks after Cyber Monday. The same number of days were used for each year. This material highlights certain product categories. Because marketplaces have different category structures, the data is presented using categories that have been standardized by ChannelAdvisor. These metrics may not represent overall e-commerce activity or the performance of any individual business, including ChannelAdvisor or any individual marketplace. Unless otherwise noted, all calculations are done in USD and are not normalized to account for fluctuating exchange rates.

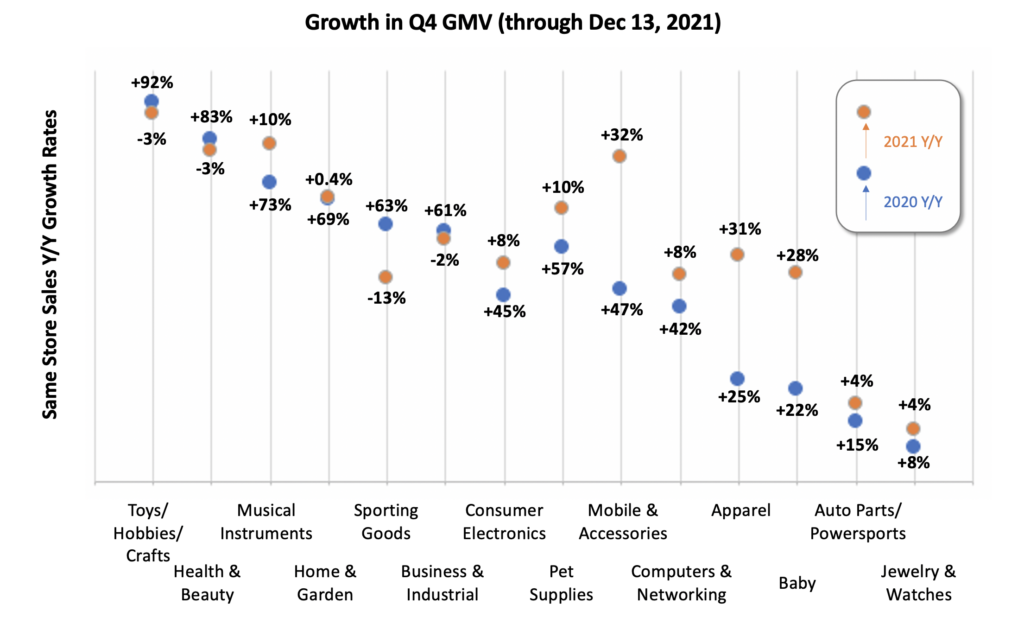

Our prior Q4 blogs highlighted category performance entering the week of Thanksgiving and performance for the week of Thanksgiving. The chart below illustrates “same store sales” category performance for Q4 through December 13, 2021 and the equivalent time period in 2020. As we noted in the first blog of this series, with pandemic restrictions easing in 2021, any growth in 2021 on top of the impressive 2020 growth (which included Prime Day in October) suggests that the acceleration in e-commerce adoption from 2020 has, thus far, stuck. Even the four categories that failed to grow this year maintained robust year-over-two-year growth.

Standout categories in Q4 2021 included mobile phones and accessories (+32%), apparel (+31%) and baby products (+28%). Each of these categories grew in 2020 as well, though not as significantly as those on the left side of the chart below. Aside from musical instruments (+10%), the remaining three of the top growth categories of 2020 were relatively flat in Q4 2021. Again, a flat growth rate is still impressive, given the substantial growth rate from last year.

Comparing all of Q4 to the category data in prior blog posts further illustrates that demand was pulled forward in 2021. Though GMV volume is always high during Cyber Week (and the days preceding Thanksgiving), growth in 2021 during this week was less for most categories than during the weeks leading up to Thanksgiving.

This is a wrap for our holiday season blogs focused on GMV performance. We hope you have a great holiday season.